GM

Welcome to issue #86 of Dune Digest.

Let’s kick things off with some exciting news…….

DuneCon 2023

DuneCon is coming back for 2023 - November 2nd, Lisbon

Last year’s DuneCon was incredible, as hundreds of Wizards took over some of Berlin’s most iconic venues for a day of networking, learning and fun……

This year we’re doing it all again.

On November 2nd in Lisbon, Portugal - one of crypto’s spiritual homes - DuneCon will return.

We’ll have a rockstar speaker lineup of the brightest minds in crypto, and we’ll be exploring the cutting edge of on-chain data analytics throughout a packed day of learning and fun.

You’ll also have ample opportunity to socialise and kick-back with your fellow Wizards from all over the world (a very smart and cool crowd).

We can’t wait, it is going to be fantastic.

More details coming soon. For now, save the date:

November 2nd, Lisbon, Portugal

Now, let’s get into this week’s data…….

Arbitrum DAOs Airdrop

Back in April, Arbitrum rewarded DAOs in its ecosystem with a significant windfall.

The Arbitrum Foundation distributed over $125 million worth of ARB tokens to 139 protocols within its ecosystem, with the protocols themselves having complete autonomy to use the funds as they saw fit.

What happened, and how did they use them? An interesting new dashboard by @shogun investigates.

The protocols received an allocation based on factors like total TVL, usage activity, transaction volume, value processed, and other key metrics.

When we look at the top 10 we see usual Arbitrum suspects like GMX and TreasureDAO, as well as big cross-chain names like Sushiswap, Curve, Aave & Balancer.

What have they done with the tokens so far?

Interestingly, three quarters of the funds are still sitting idle in protocol multisigs:

The top 3 recipients - GMX, Sushiswap and TreasureDAO - still hold their entire airdrop.

As for the rest, various protocols have used their drop differently - for everything from rewarding liquidity providers and incentivizing growth to extending their financial runway.

Some categories have spent more of their funds than others. For example Yield protocols have seen the sharpest decrease in their holdings, which dropped by more than half to just $4.5m:

The largest recipients - DEXes - have seen a less significant drop in their holdings. They’ve still reduced by ~1/3 though, falling from ~$30 to ~$20m:

Overall, the results of this experiment are quite interesting.

The biggest benefactors have not used their airdrops at all.

Others have been using them strategically to support operations, incentivize users & developers, and to improve their financial stability.

This was just the tldr, it goes much deeper. Read this great article for more analysis, and this thread by the dashboard’s creator.

And of course, check out the full dashboard for more data.

Tribe3

Tribe3 is an interesting protocol. The NFT perpetual futures exchange allows users to leverage trade NFT floor prices.

It also leans on gamification and introduces virtual liquidity as an answer to the fundamental illiquidity of JPEGs.

It is still in public beta, but we’ve got an interesting new dashboard from @tribe3 themselves to break down. Let’s take a look.

There have been ~15.5k trades in total, and trades have been rising nicely through late June:

And though there have only been 382 traders, they’ve done more than $22m in volume:

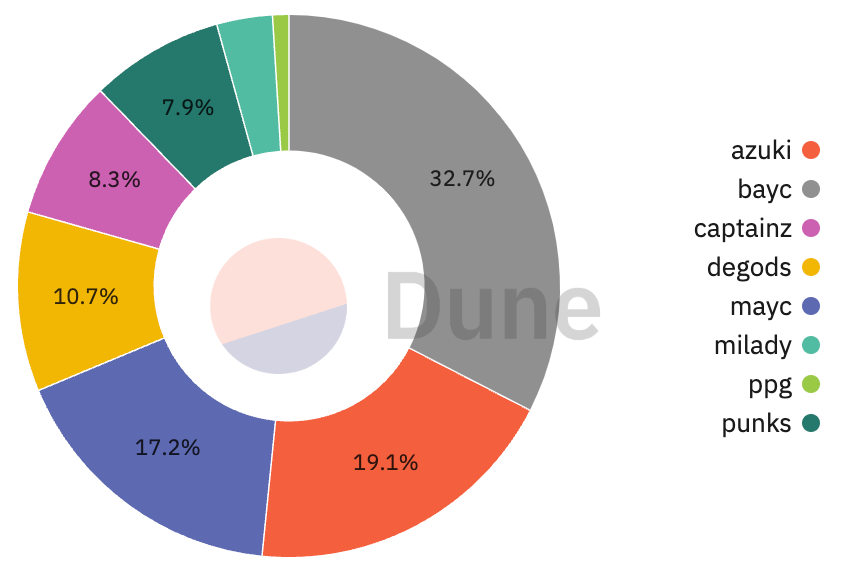

Some predictable blue chip collections are driving the majority of volume. BAYC account for 32.7%, with Azuki in second place at 19.1% and MAYC in third at 17.2%:

Let’s look at open interest, where we can see a strong growth trend over the past several weeks.

The open interest’s notional value is now at ~372 $ETH!

An interesting protocol, with the potential for real innovation in the NFT space.

Keep an eye on it through the full dashboard.

Prime Trust

Prime Trust is a large crypto custodian which has been having major solvency problems recently. The root cause was supposedly losing access to “legacy wallets” and (alleged in court) using client fiat deposits to cover crypto withdrawals.

This week they were placed into receivership, with the fallout still ongoing.

To add to the context, a new dashboard by @21shares_research tracks some important metrics. Firstly the balance of the tracked wallets is at ~$66m:

This is close to their crypto liabilities according to several sources.

Around ~$200k of this is in stablecoins.

Interestingly, the largest holding is $AUDIO, the native token of Audius, a decentralized music streaming platform.

$AUDIO accounts for over 88% of Prime Trust’s crypto holdings. After that there’s ~$7.5m worth of BTC, ~$200k worth of stablecoins, and a little $ETH:

This is a far cry from the past. Back at the beginning of 2022 these wallets held ~$800 million in value.

After dropping one year ago, the balances had been climbing again until late May:

TVL dropped dramatically in late-May following some large $BTC outflows of over $300m in just one week. The two largest transactions accounted for ~$270m alone:

The fallout continues, and this is just a snapshot of the relevant data. Keep your eye on Dune trending dashboards to follow any important developments.

@21shares_research do great work with their “contagion” series. Check out the full dashboard for much more data.

Solana’s Compressed NFTs

Solana has been out of the crypto headlines for a while, but they keep building for the future.

Back in April they introduced compressed NFTs. According to a new dashboard by @dareplay_xomnft, compressed NFTs are:

“A new class of non-fungible tokens (NFTs) called compressed NFTs that employ a technique known as state compression to reduce the load of data storage. State compression uses a Merkle tree structure to store the minimal amount of data on-chain in order to confirm that the underlying data is correct. This technique drastically lowers the cost of storing information on-chain and brings down the cost of minting 1 million NFTs on Solana to ~$110”

So the idea is for state compression to drive efficiency gains that significantly reduce minting costs. How is that working out so far?

Pretty well it seems. Almost 11.5 million of these NFTs have been minted:

This only cost ~$1270 in minting fees. That is very low.

We all know that NFTs are in a bit of a “winter” at the moment. It is the perfect time to build the next generation of technology, but expecting mass adoption in the short term isn’t always realistic.

That said, adoption of compressed NFTs on Solana has grown steadily through Q2. Roughly one month ago, daily mints crossed 600k for the first time, and there have been regular days in the hundreds of thousands in recent weeks:

Only 7 projects are really making use of this tech so far with Drip Haus, Mad Labs, Dialect and several others all minting 100k+ NFTs:

If and when another NFT bull market comes, this will be an interesting space to keep an eye on.

Check out the full dashboard for more data……

3pool

Curve’s 3pool is one of the most important DEX pools in DeFi, facilitating low-slippage swaps between three of the major stable coins: $USDT, $USDC & $DAI.

It has been the centre of some drama in recent months, and a new dashboard by @xmc2 gives us some useful stats. Let’s check it out.

3pool’s TVL is at an impressive ~$318 million:

That might sound like a lot these days, but historically it’s nothing!

Back in early ‘22 TVL hit $6 Billion. A few months later in May ‘22’s infamous market crash it dropped sharply, and since then has been sliding slowly:

To function optimally, 3pool should have roughly equal amounts of each stable coin. This fluctuates often, but recently Tether’s $USDT has been more volatile than usual in the pool.

In March for example, $USDT fell to only 2.4% of the pool, while a couple of weeks back it surged to over 60%:

Right now the pool is relatively balanced, albeit still overweight $USDT as usual due to the recent depeg and drama around the token:

An interesting dashboard covering this important piece of DeFi infrastructure.

Check out the full dashboard for more data.

More Dashboards

GN

Thanks for reading, and of course - a special thanks to all contributing Wizards for your excellent work this week.

We can’t wait to meet you all again at DuneCon.

November 2nd, Lisbon - save the date.

See you next week for more data, dashboards and Wizardry.

Gu