GM

Welcome to issue #85!

Some exciting news to kick things off.

We're very happy to announce that... Celo data is now LIVE on Dune!

Celo is a carbon-negative, mobile-first, EVM-compatible chain. It has a robust ecosystem of apps and and a large user base!

Celo Foundation Partner Kevin Tharayil said:

"Dune Analytics and its community data platform bring critical infrastructure and expertise, transforming on-chain data into meaningful industry insights. With more than 1,000 mission-driven projects, users and builders will learn more about Celo and the community's mission to create the conditions of prosperity for all"

Celo data is still fresh, but you can submit contracts for decoding here.

The Celo Foundation will also be hosting a data contest with 5k in $cUSD up for grabs. Details coming soon.

We’re excited to see what you build as always.

In fact, the building has already started. Let’s take a look……

Celo

Celo's ecosystem is known for global payments, social impact projects, and financial access through a smartphone first design philosophy.

Since Celo data is now live on Dune, we can check out some key stats through a dashboard by @springzhang…..

Celo has seen significant usage, processing ~225 million transactions for over 2.3 million users:

Users have been increasing significantly recently, to almost ATH levels!

That’s unusual considering this chart, which shows transactions are way down from late 2022 highs.

Still, there has been a noticeable uptick in transactions over the past few months.

When we look more specifically at the user metrics, they’ve been hitting 70k+ daily in recent weeks.

According to another dashboard by @celo themselves, most of this recent growth has been driven by a significant bump in new users throughout Q2:

How about contracts and developer activity?

There have been ~12.15 million contracts created in total. This peaked back in late 2021 and early 2022, and has never recovered to those levels.

Still, there is a steady hum of activity. Throughout May for example, there were around ~11k contracts created:

Celo certainly has an interesting ecosystem for Wizards to dig into. We’re looking forward to seeing what you can build with the data!

You can start off by checking out these dashboards:

Zora Network

Since launching into the emerging NFT marketplace space in 2020, Zora has become a well-established brand in the world of NFTs.

Where other marketplaces like OpenSea opted for high scale and mass markets, Zora has evolved into more of a creator-centric ecosystem.

Zora hasn’t reached same heights as marketplace giants, but has still seen significant success - raising $60m and serving 100k+ users.

This week they announced Zora Network, an L2 designed specifically to support digital artists and collectors. Zora Network is built on top of Optimism’s tech stack, already integrated with 30+ platforms, and claims to bring down minting costs to ~50 cents.

We can see some initial stats through a new dashboard by @pandajackson42.

Zora Network is only a couple of days old, but has already seen over 10k addresses bridging to the network:

Its TVL has reached ~118 $ETH:

That’s over $222k!

The concept of an L2 tailored to a specific use case is an interesting one, and so far it seems to be a well executed launch by Zora. We’ll be keeping an eye on this project!

To get much more data, check out the full dashboard.

(ps: If you want to learn more about Zora Network, Bankless did a good interview with Zora’s co-founder)

Sound.xyz on Optimism

Earlier this month the premier music NFT platform, sound.xyz, launched on Optimism.

The moment was celebrated with the release of a special track - “V Buterin” - paying tribute to Ethereum’s founder.

A dashboard by @oplabspbc gives us some data on how things are going so far, let’s take a look.

The first editions were released on 9th June, and since then there has been a steady stream of editions released:

48 are now live on the platform, by 48 individual creators.

So far, so good. The amount of mints and collectors though is quite amazing. There have been over 730k collectors:

The first week saw 10k+ collectors daily. Things took off last weekend though with ~90k collectors on Saturday and 145k on Sunday.

On Monday, things really peaked with 425k collectors!

This coincided with the last day to mint “V Buterin”, and as you can see from the chart above, mints dropped to practically nothing from Tuesday onwards.

But it isn’t really nothing.

The V Buterin mint was free, and took off on social media. Music NFTs are still an emerging category, and such huge scale could only come from a viral meme.

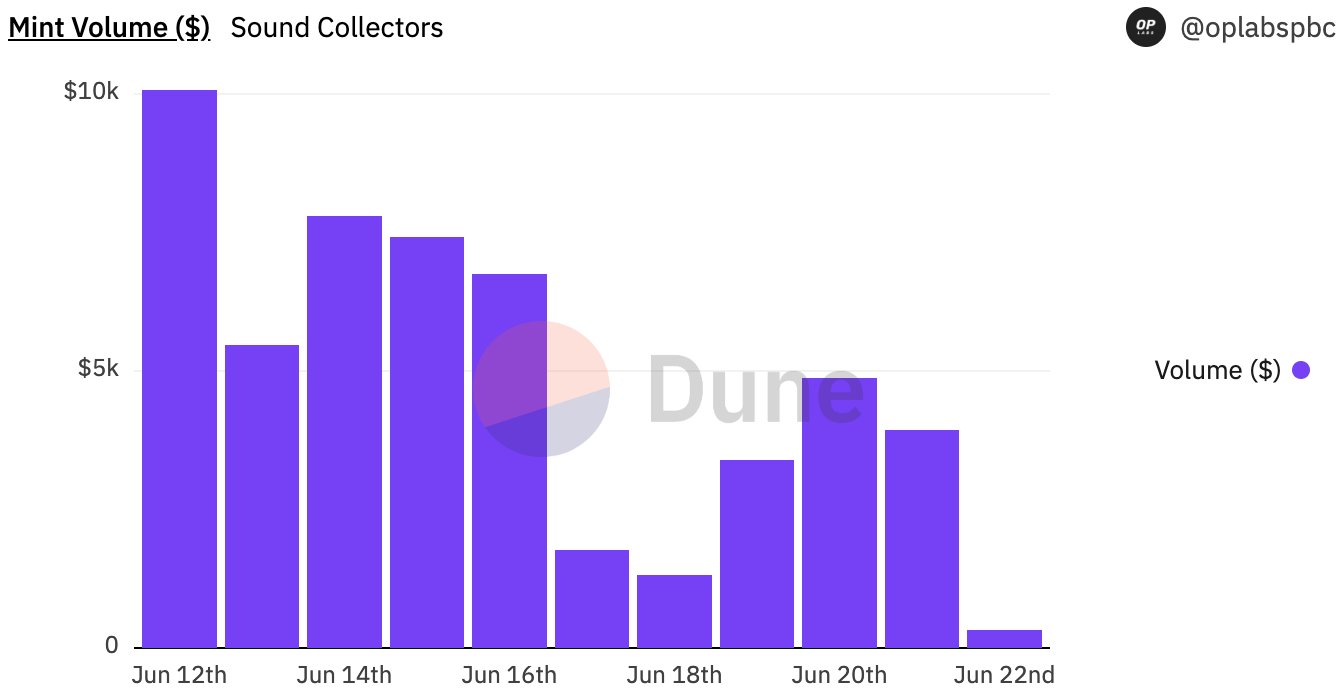

In the days since there have still been hundreds of mints daily, and thousands in mint volume:

The leadership of Sound see Optimism’s scale and affordable transactions as crucial to their long-term vision, so it’s an important milestone to launch on the network.

To learn more about Sound on Optimism, check out the full dashboard…..

Solana Activity

Solana is still humming away, with quite some activity going on every month. A new dashboard by @web3academypro looks at the different kinds of usage Solana has seen, both now and historically. Let’s explore.

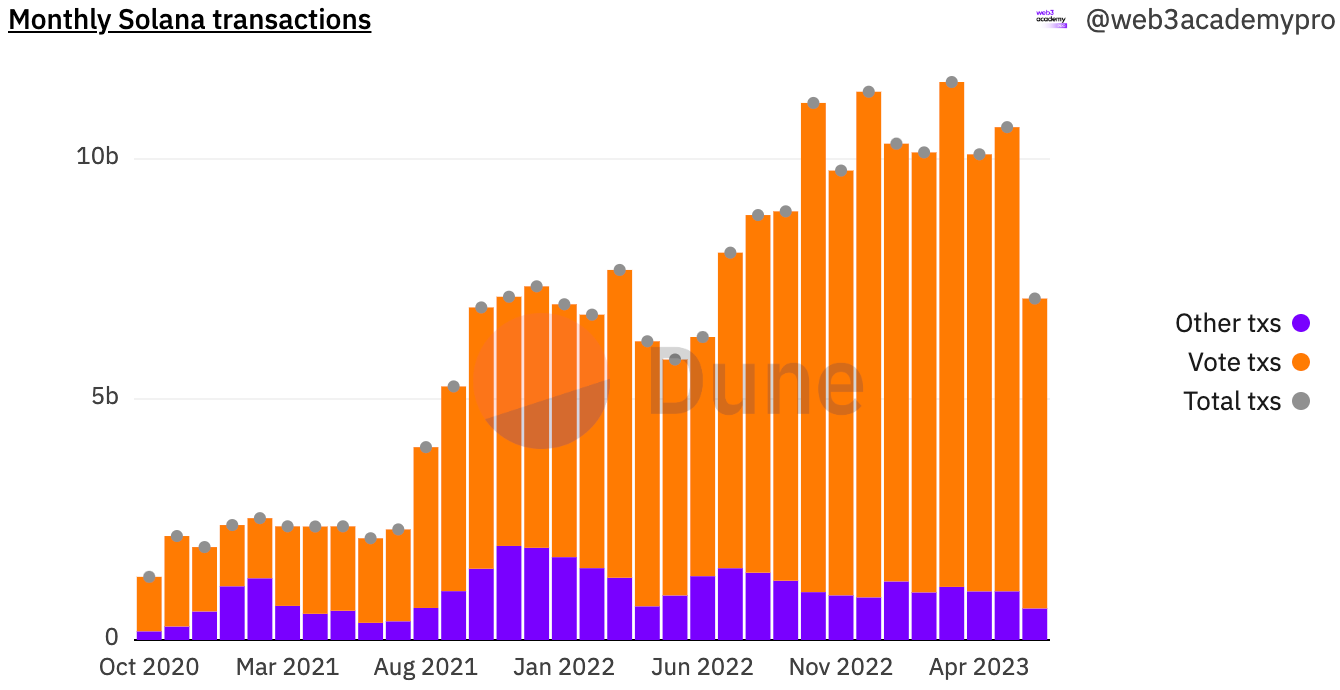

Firstly, you have to be careful when you look at “transactions” in Solana because there are two kinds, vote and non-vote.

Vote transactions are performed by validator nodes as part of Solana’s network consensus system. Non-vote are the “real” user transactions like transfers, mints, and contract interactions.

Vote transactions make up a significant majority of the total, and have grown to 10+ monthly over the past year. Vote transactions growing while prices crater is an interesting trend.

In the chart below, you can also see that the “real” non-vote transactions have been dropping through the same time period, but nothing extreme. According to the dashboard, there are still ~1B non-vote transactions per month.

What is causing that drop?

It is mostly Solana’s faltering DeFi ecosystem. DeFi transactions dropped massively in Q3 of last year. This was connected to the ongoing (at the time) implosion of FTX, a major backer of both Solana and major Solana DeFi protocols like Serum.

Over the past few months, there have been around ~70m monthly DeFi transactions on Solana. Not bad, but a far cry from the past:

As DeFi transactions dropped, Solana’s NFT sector boomed. Through the middle and end of 2022 it saw impressive growth, and Magic Eden established itself as the dominant player:

When we shift to active wallets using NFT marketplaces on Solana though, the picture is not so rosy. Since the beginning of 2023 this metric has steadily dropped, from 180k in January to 80k last month:

So though the Solana NFT space seems to be faring better than DeFi, the trend is still negative.

Finally let’s look at Solana’s other main sector - gaming.

Gaming transactions have stayed relatively stable throughout the past 18 months at over 1 million monthly.

The original most popular game was Star Atlas, but over the past year things have become more diverse, with hundreds of thousands of transactions for Genopets, YesGnome and Aurory:

Overall Solana was hurt significantly by last year’s market crash, particularly due to their perceived close ties to FTX. Reports of Solana’s demise are premature though. It is still a lively ecosystem with a lot of activity, and may be positioned well for the next wave of adoption and use cases.

For much more data, check out the full dashboard!

$TUSD

TrueUSD (TUSD) is a centralized stablecoin that, like USDC and USDT, is pegged to the $. It’s known for being well audited, transparent, and using a system of multiple escrow accounts.

$TUSD has been making headlines for its connections to the embattled Prime Trust, its loan APR recently rising to ~30%, and traders opening multimillion dollar shorts. Is it in trouble?

Let’s check out some key stats through a new dashboard by @stablecamel.

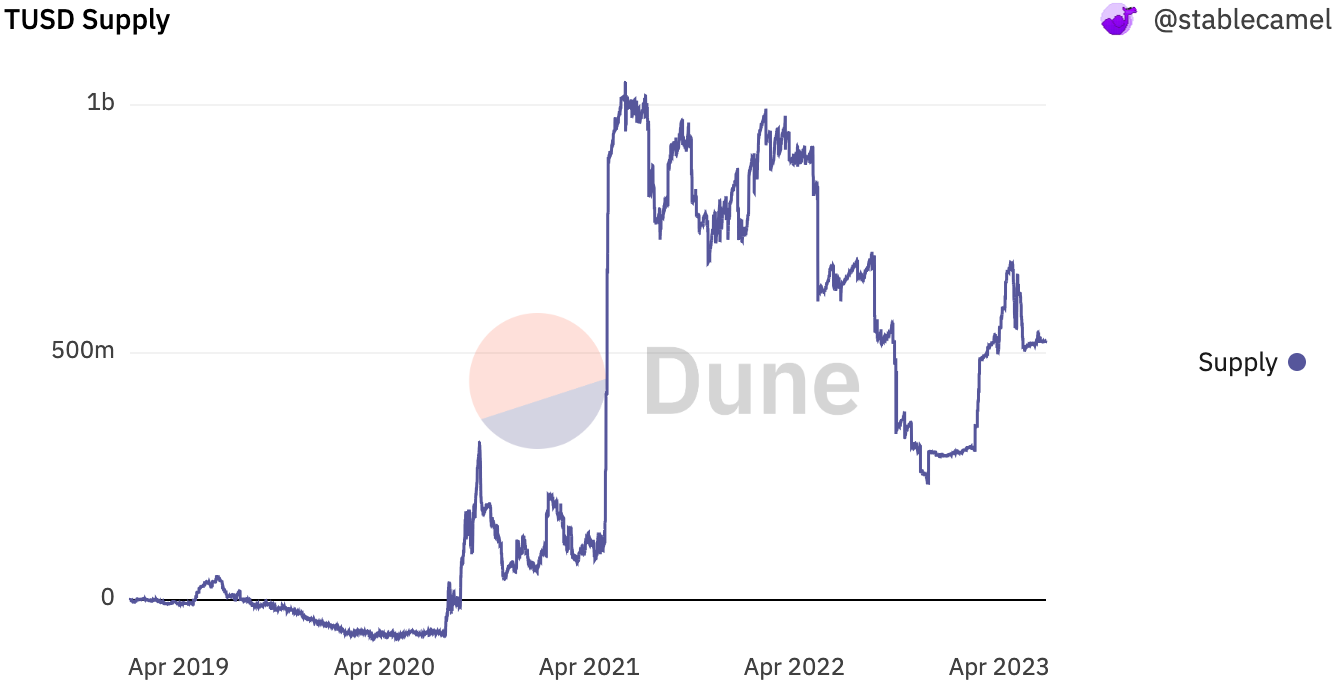

The total supply is over half a Billion:

This is ~50% off its ATH, which occurred in May’21 when $TUSD supply briefly peaked at over $1b.

This dropped in early 2022, but has been growing again steadily through 2023:

(Note: this is only for Ethereum, $TUSD is also on BNB, Avalanche, and other chains)

Now, let’s look at liquidity.

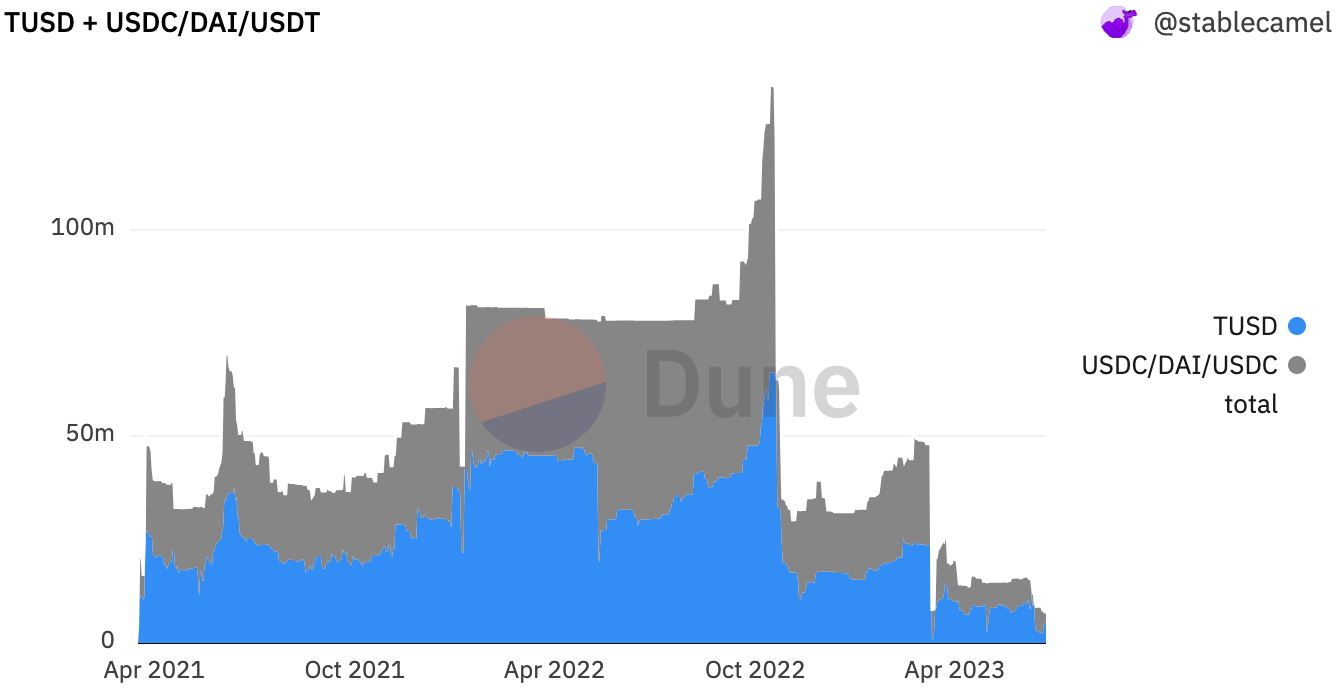

Liquidity on Curve has been falling in the $TUSD-$FRAX Base Pool. It was over $20m earlier this year, but has now fallen to ~$1.5m:

In the other large pool, TUSD + USDC/DAI/USDT, liquidity has also been falling sharply in recent months:

Is this affecting the peg stability? Some traders are betting that it will, and have been opening large shorts recently.

So far there hasn’t been major peg volatility, although you can see that $TUSD depegged for several days, dropping to $.9954 and rising to $1.003 through a turbulent week:

Volatility was higher on other chains.

Overall, it seems like the past week was a volatile one for $TUSD. Liquidity remains low, and crypto users are more skeptical than they were in previous years. It will be interesting to see how this unfolds.

Check out the full dashboard for much more data.

More Dashboards

GN

Thanks for reading, and a special thanks to all contributing Wizards.

We hope you have a good weekend, and we’ll see you again next Friday for more data, dashboards and Wizardry.

Nice!