Dune Digest #84

LSDfi, Ethereum L2, Arbitrum, Blue Chips!

GM

Welcome to Issue #84 of Dune Digest! 🧙♂️

We have some great dashboards to dive into this week. Let’s get right to it.

Ethereum vs L2s

Ethereum L2 scaling platforms have truly arrived. One year ago they existed, but were still somewhat nascent. Now though, they’re big time.

A great trending dashboard by legendary Wizard @jhackworth compares Ethereum to its L2s, let’s look at the key takeaways……

A lot has changed over the past 12 months. One year ago, there were far more transactions on Ethereum.

Over time though, L2 transactions started to grow as a portion of the total, and “flipped” L1 transactions in mid Q4 ‘22:

Nowadays they process around twice as many transactions as L1.

Over the past 12 months Ethereum has still processed more transactions overall (380m) than its L2s (336m). If the current trend holds though, this won’t be the case for the next year……

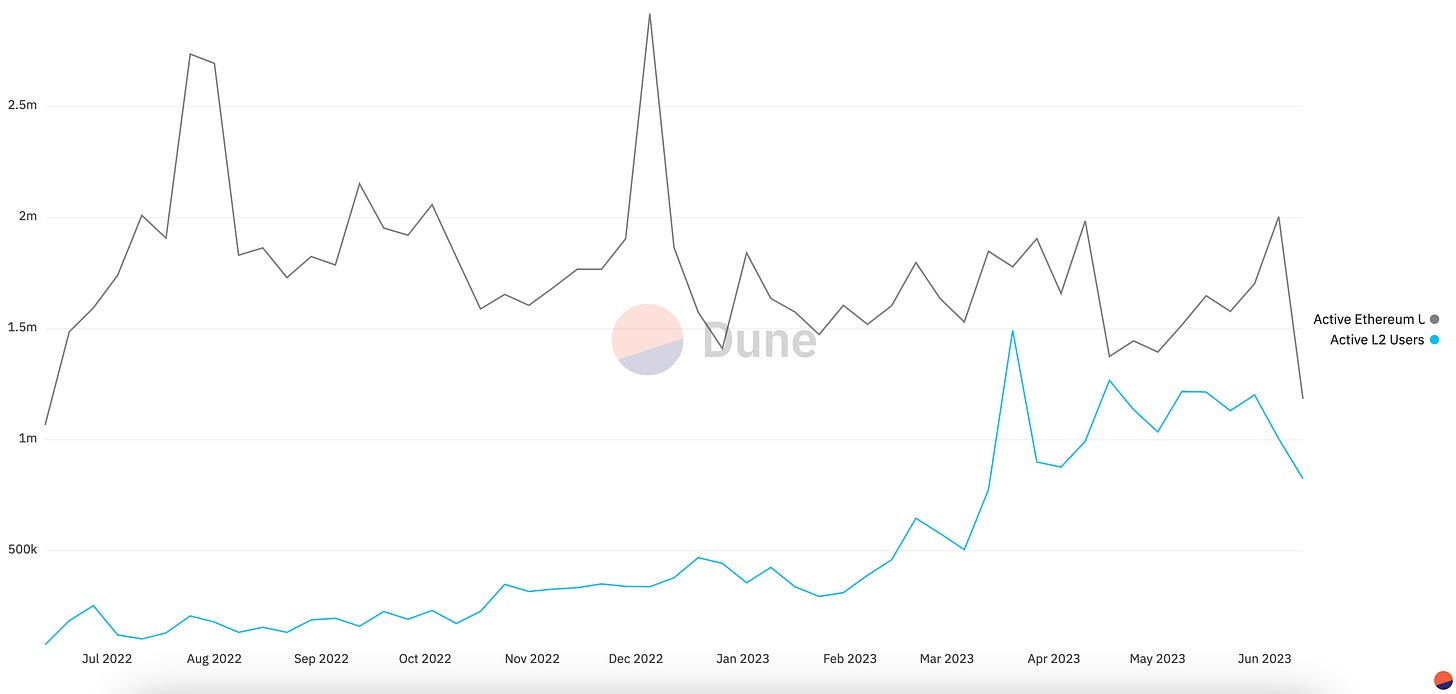

When it comes to active addresses, L1 Ethereum is still in the lead.

Again though, the gap is narrowing. One year ago there were more than 10x more active addresses on Ethereum itself.

Over the past week there have been:

1,184,514 Ethereum addresses

825,918 L2 addresses

Breaking down these user metrics further, we can get some interesting insights.

Polygon is leagues ahead of the others, with 35.2m active wallets over the past week alone. Arbitrum only recently surpassed Ethereum slightly, and Optimism still lags well behind:

It’s clear that L2 rollups and Ethereum scaling solutions have truly arrived and are finding a strong market fit. They’re no longer experimental novelties, but rather core parts of Ethereum’s wider ecosystem.

There’s a lot more interesting data in this dashboard, particularly on the impact of the various airdrops on usage metrics.

Check out the full dashboard for much more…..

LSDfi

The Shapella upgrade has enabled an interesting new crypto category - LSDfi - a fusion between liquid staking derivatives (LSDs) and DeFi.

What’s the deal?

LSDs allow one to work around the “locked” nature of $ETH staking. They represent staked funds, so that users can trade them, borrow against them, and generally have fun with them while the original funds are still earning staking rewards!

LSDfi is the term given to the lively ecosystem that has sprung up around them. A recent dashboard by @defimochi gives an interesting breakdown, so let’s look at the highlights…..

Let’s start off with the fact that this category is already huge, closing in on $400m in TVL:

The top 5 market leaders account for ~80% of that.

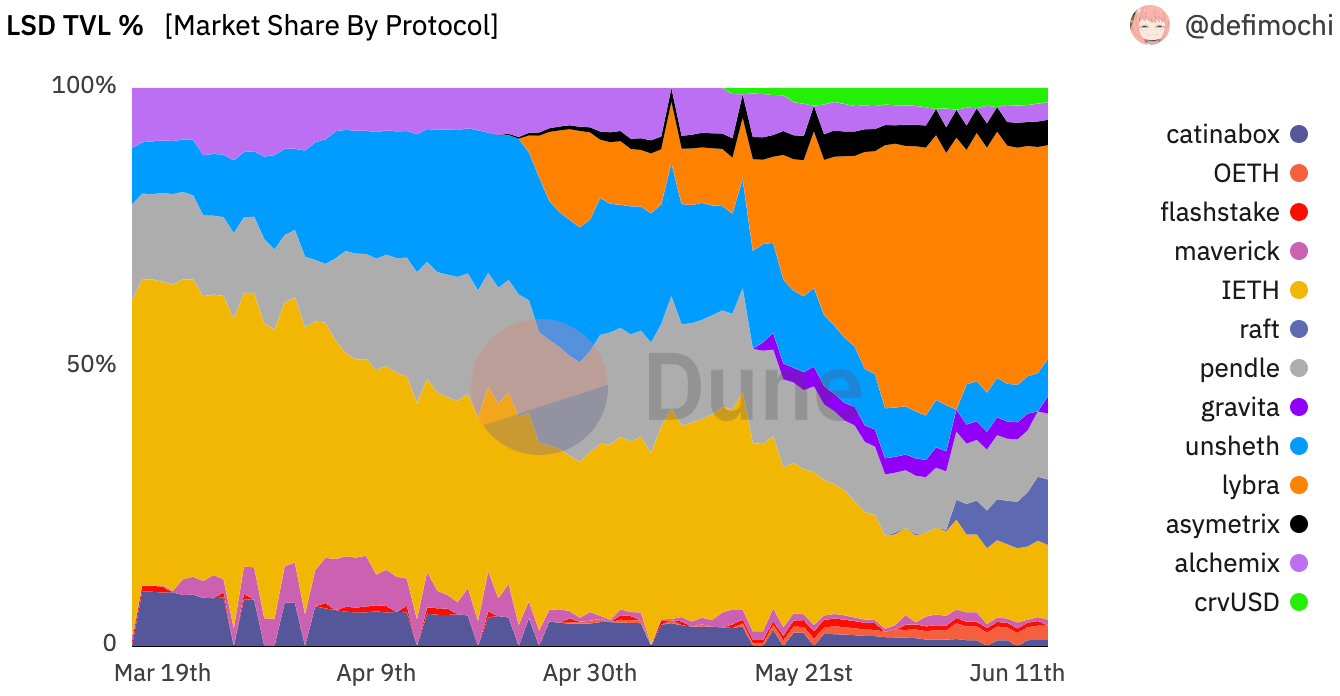

Lybra, an LSD-based stablecoin protocol, currently leads the market with ~38% of TVL.

Raft, another LSD stablecoin protocol which we covered in last week’s edition, has already captured almost 12%:

Lybra hasn’t been the market leader for long though, and things are moving fast. The past month has seen Lybra’s marketshare explode, as $iETH, Unsheath and others have seen a relative decline:

This is amid huge inflows to the category though, and an overall boom in TVL.

3 months ago total TVL was <$100m.

In mid May it was only at ~$140m….. so it has grown by more than 2.5x over the past month alone!

All this growth is fuelled by a handful of tokens.

The biggest and most widely used is $stETH with over 57% of total marketshare and $220m in TVL!

All these tokens have seen significant growth in recent weeks and months:

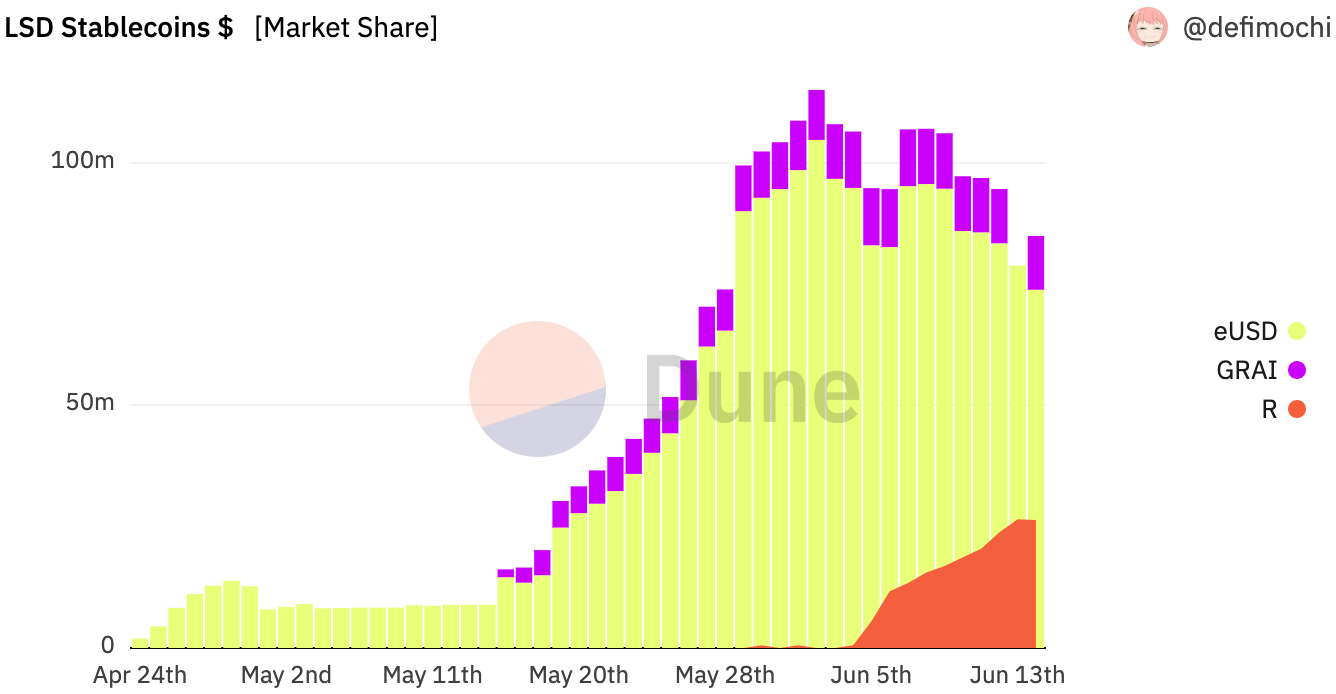

One of the major use cases so far is LSD backed stablecoins.

Though a new category, the combined supply of these stables is already over $100m.

One month ago it wasn’t even at $10m, and there was only one player, $eUSD.

$eUSD is still market leader with the majority of supply, but $GRAI and R are making progress:

A great dashboard with lots more data.

To learn more about LSDfi - check it out!

Arbitrum’s Airdrop Success

We haven’t covered Arbitrum in a while, and news has been dominated by other topics.

Arbitrum didn’t go anywhere though, and has been humming away quietly in the background. A nice new dashboard by @salva dives into the core metrics, so let’s get a refresh…..

Arbitrum’s TVL exceeds $4.1 billion:

Despite the bear market, Arbitrum’s TVL grew healthily through 2023 so far, reaching its peak in mid-April at $4.32 billion:

TVL has dropped a little through May and June, but is still higher than it has ever been prior to Q2 2023.

It’s also interesting to look at Arbitrum’s core metrics before and after the ARB airdrop in March. As you can see in the above chart, TVL has been consistently higher post-drop.

It’s the same story when we look at active addresses.

Arbitrum has had over 8.35 million total users in its history:

The majority of these have been in Q2 of 2023, as active users boomed to new heights following the airdrop.

Over the past few weeks active addresses have fallen - last week saw 1.15 million active addresses - but are still significantly higher than before the drop.

Transactions actually peaked just before the airdrop, but again the average weekly transactions have been much higher since the airdrop.

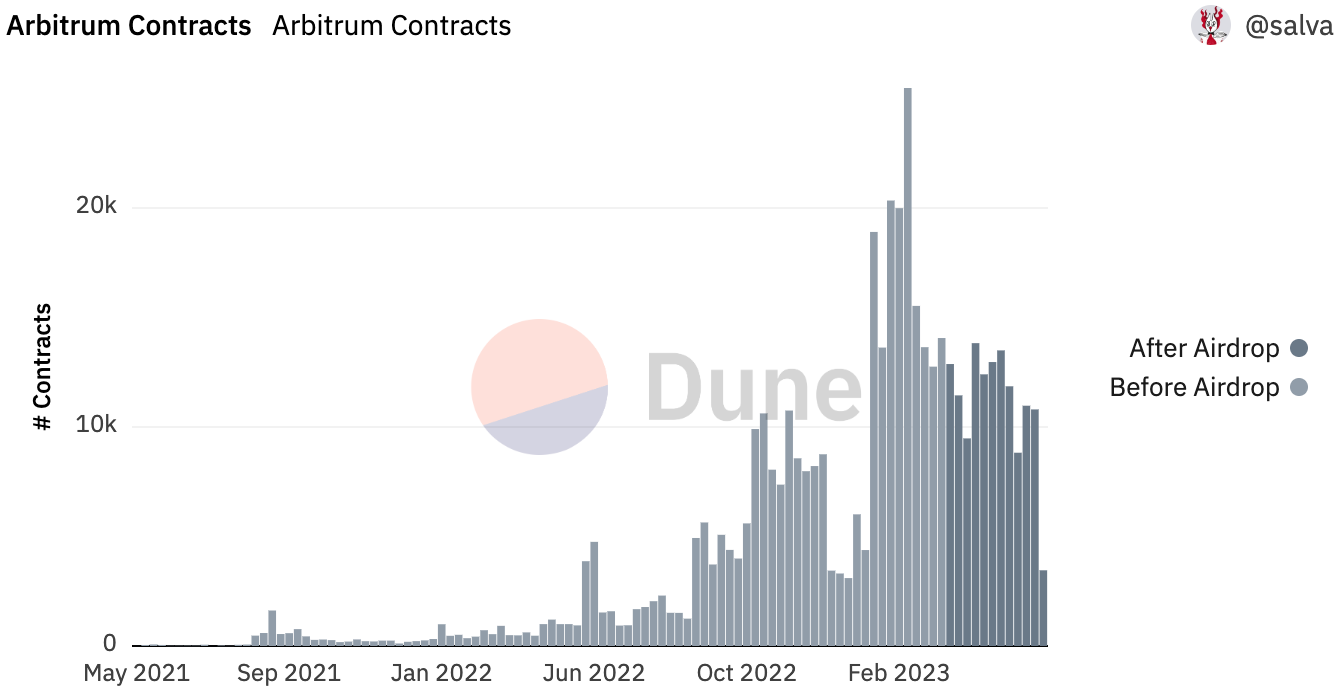

One notable exception to the trend is contracts created.

Arbitrum has seen ~467.8k total contracts created. New contracts actually peaked in Q1, and have fallen since the airdrop….

Contracts remain higher than pre-2023 though:

Overall it seems like Arbitrum’s airdrop has been a success in driving up core metrics.

These metrics have also stayed up over a whole quarter, and amid difficult market conditions.

This isn’t a given by any means, and points to an airdrop done right.

Check out the full dashboard for more data.

Blue Chip NFT Performance

We’ve all heard about how the NFT market is having a rough time in recent months, and its true.

Through the last bull market, news was often dominated by so-called “blue chips” - pieces from famous collections like BAYC and CryptoPunks. It was often said that these blue chips would retain value through market crashes, and were good long-term investments.

How accurate has this been?

We can find out through a new dashboard by @russwest.

The worst performer has been Moonbirds, which over the past year has seen a ~50.13% floor drop over the past 90 days and a ~90% drop over the past year.

Market cap has dropped from $500m to ~$35m in around one year, and floor price from 28 to 2 $ETH…..

They aren’t the only ones though.

Doodles and CloneX haven’t fared much better, with both losing 80%+ of their floor since one year ago!

In fact, only 2 collections saw a growth in $ floor price over the past year. The two big winners are:

Miladys up 503.57%

Pudgy Penguins up 250%

If we look at $ETH floor price, we can add Azuki and BEANZ to successful collections.

Let’s zoom in to the past 30 days where we can find a few recent winners. Mfers have done well, with their floor price rising over 24% in $ETH terms.

DeGods, y00ts, and Azuki have also seen some success.

Overall, it’s clear that the NFT market isn’t “dead” completely, but it is a shadow of its former self.

Even the vaunted blue chips have bled, although some are doing better than some might guess.

@russwest wrote an excellent Twitter thread summarising the dashboard’s insights, and concluded that there are 5 keys to success for an NFT project:

Food for thought, indeed. With the new NFT token standards and capabilities coming out recently, maybe this list will be added to?

Check out the full dashboard for more…….

Unibot

Unibot is a Telegram bot that helps users to “snipe” opportunities on DEXes and execute profitable trades.

This week it migrated to V2, and an interesting dashboard came out by @whale_hunter that analyses its business model. Let’s take a quick look.

Unibot makes money from "a “tax” on trades. Already this has generated almost 38 $ETH,

The tax revenue is shared between $UNIBOT holders and the team, and pays out once a certain threshold has been reached.

So far almost 17 $ETH of tax revenue has already gone to holders, and APR is estimated to be over 30%:

It’s quite an interesting tool with what looks like a solid revenue model. Check out the full dashboard for much more data…..

More Dashboards

Fundamentals of Liquid Staking Derivatives by @21shares_research

NFT crosschain usage - ERC721 + ERC1155 on EVM chains by @sealaunch

GN

Thanks for reading another edition. And as always, a special thanks to all the wonderful Wizards for their efforts.

Have a great weekend, and we’ll see you again next Friday.