Dune Digest #83

Bedrock, Helium, Bitcoin NFTs, ERC-6551 & more!

GM

Welcome to Issue #83 of Dune Digest!

🧙♂️ have been busy this week - and we’ve got a great issue for you, with exciting stories on Optimism’s latest upgrade, the Bitcoin NFT ecosystem, a new NFT token standard….. and more!

Let’s get straight into it.

Optimism Bedrock

This week, Optimism completed the much-anticipated Bedrock Upgrade. Bedrock is a pretty big deal for the network. According to Optimism themselves:

“Bedrock improves on its predecessor by reducing transaction fees using optimized batch compression and Ethereum as a data availability layer; shortening delays of including L1 transactions in rollups by handling L1 re-orgs more gracefully; enabling modular proof systems through code re-use; and improving node performance by removing technical debt”

Essentially, Bedrock seeks to lower gas fees through smart data compression, reduce deposit times, and improve modularity and interoperability with the OP stack.

Bedrock brings Optimism one step closer to its “super chain” vision, and was supported overwhelmingly by the community with 99.8% of the 27.9 million $OP votes in its favour.

How has it impacted the network so far? Let’s take a look through a new dashboard by @oplabspbc…..

This is an excellent dashboard, and there’s a lot to take in. Let’s start with transaction fees.

Lowering fees was one of Bedrock’s core goals. So far, things are going great on that front. Bedrock has already saved users over $133k in transaction fees:

That’s an average of 56.6% savings per transaction. Not bad at all, especially when you consider that fees were already low.

Now the average transaction fee is just 16 cents!

Breaking this down further, both average gas fees and the savings brought by Bedrock vary depending on the type of transaction.

DEX trades for example now cost just 9 cents, down 55% since Bedrock. $ETH transfer fees have dropped the most, down 66% to a minuscule 4 cents!

The most expensive transactions, contract deployments, are down “only” 33% - and now cost $2.99…….

Overall, very impressive savings.

Bedrock also introduces L2 blocks, a 1559-style price model for gas, and new methods for submitting data to L1.

You can get a ton of data on all this in the dashboard, but let’s see some highlights.

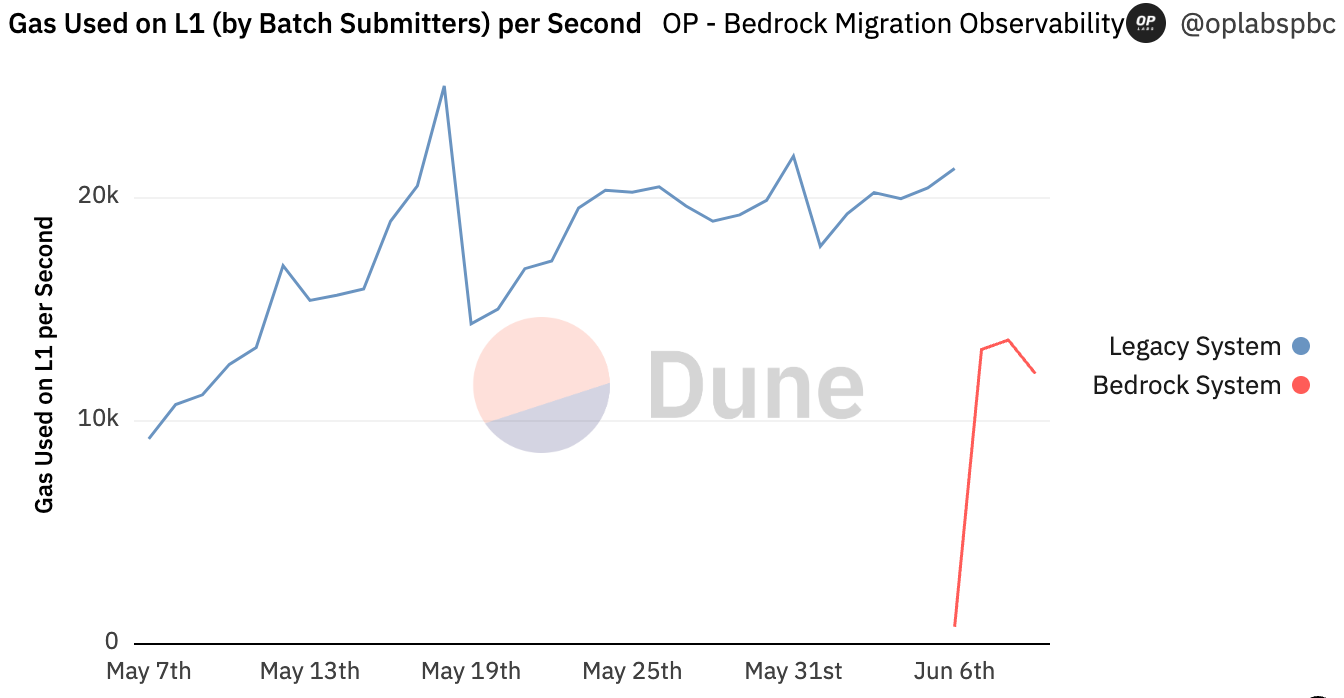

Firstly, Bedrock has clearly reduced the L1 gas usage (by Optimism) significantly.

This plays into Optimism’s “rollup economics” and larger business model in interesting ways.

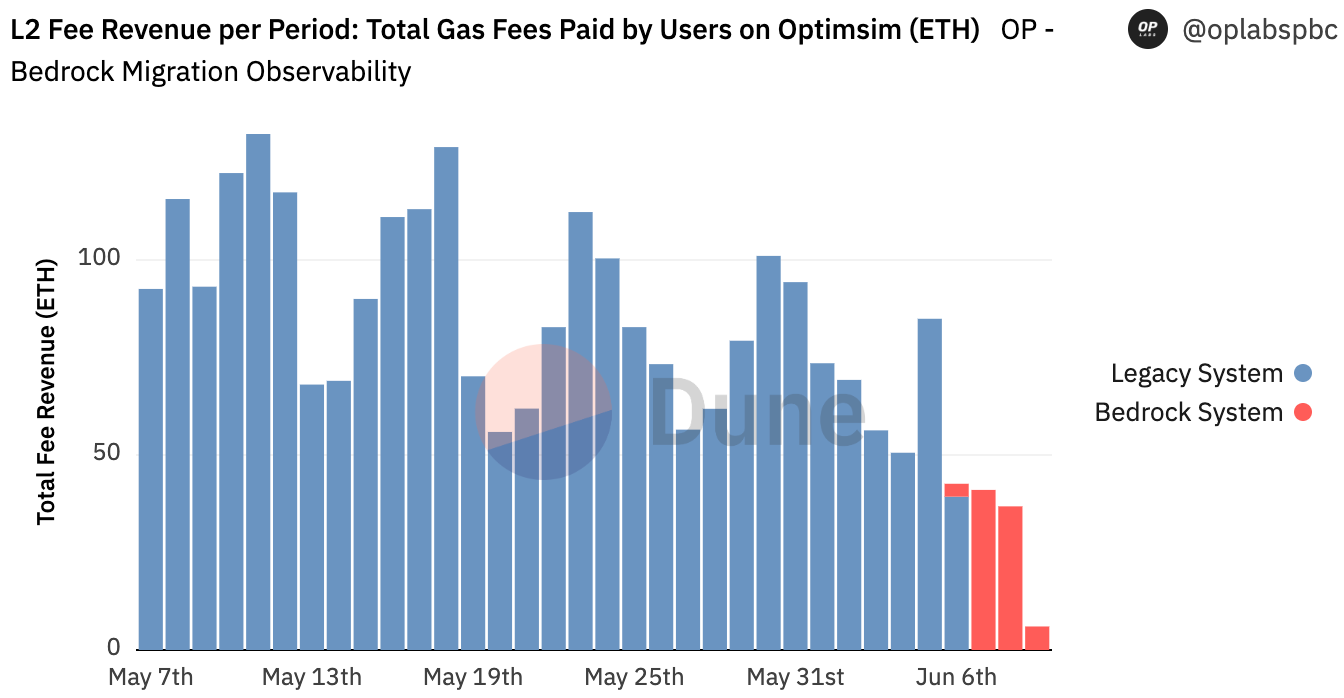

We can see that Optimism’s fee revenue for the first 2 days of Bedrock was 41 & 37 $ETH.

This is significantly lower than the sky high revenues of 100+ $ETH from early May:

But we need to consider that this is still the very beginning, and Optimism’s operating costs will also change. These two days also saw the lowest L1 data costs throughout the entire period.

Overall, Bedrock seems like a significant success so far. It has noticeably reduced fees for users, already saving them six figures in fees in just a few days.

Congratulations to Optimism. It will be interesting to monitor these stats to see the wider impact in the weeks and months ahead.

To get much more data, check out the full dashboard.

You can also take a look at this dashboard to see Optimism transaction costs vs L1.

Helium Network

Helium is a decentralized, global network based around "hotspots" in people’s homes.

It is designed primarily to power IoT devices, with hotspots both providing connectivity and verifying transactions on the network to earn native currency $HNT.

Helium recently migrated to Solana. Now that we have Solana decoded data we can take a look through a dashboard by @helium-foundation…..

The dashboard focuses on “Data credits”, which are used to pay for data transmission and acquired by burning $HNT. You can read more in their docs.

There’s a little under $1.7m of data credit in existence:

The daily amount burned for network usage has been creeping up over the past few weeks.

It’s still on a relatively small scale though, with credit burns hitting ~$1400 on recent days:

The two main functions that credits are burned for are “onboard” and “assert”. We can see that in recent weeks the vast majority have been used for onboarding.

It’s an interesting and ambitious project. If IoT really takes off in the coming years, Helium could be well-positioned for a potentially huge market.

Check out the full dashboard for more…..

There’s a whole world of exciting Solana projects available for Dune Wizards to investigate now. Exciting times!

Interested in decoding a particular Solana program? Submit the IDLs here.

And don’t forget to join our Solana decoding channel on Discord!

Bitcoin NFT Ecosystem

If you’d talked about “Bitcoin’s NFT ecosystem” one year ago, you’d have been met with raised eyebrows at best, derision at worst!

Now though, everyone will know you’re talking about Ordinals, which boomed over the past few months.

A lively secondary market, along with competing marketplaces, has also sprung up around this space - covered by a new dashboard by @thb3100……

Ordswap was early to the game, starting to process a few transactions in early February.

By March though, other players had seen the opportunity, with Magic Eden, Ordinal Wallet and Gamma all launching in late Q1.

Ordswap is a good example of how first mover advantage isn’t everything.

As soon as competitors launched, first Ordinal Wallet then Magic Eden started taking the large majority of marketshare:

Volume stayed relatively low until around one month ago when it exploded - with market leaders Ordinal Wallet and Magic Eden well positioned to take full advantage:

It wasn’t just a volume explosion due to rising prices either, the number of both traders and transactions boomed at the same time.

Again Magic Eden dominates in this metric, processing ~85% of total transactions over the past several weeks.

Magic Eden is also the only platform which has seen daily trader growth since mid-May:

Magic Eden has seen over 42k total traders, a full 14k more than Ordinals Wallet in second place.

Ordswap and Gamma are way behind with only a few thousand each.

Overall, Magic Eden is the clear market leader capturing:

55% of transactions

54.7% of traders

50% of volume

Ordinal Wallet is in a strong position in second place.

As a marketplace traditionally associated with the Solana ecosystem, Magic Eden made a smart move by quickly capitalizing on the Ordinals trend and is now well positioned for however Bitcoin NFTs develop in the future.

Check out the full dashboard for much more data…..

Raft

Even though many say we’re in a crypto winter, innovative new projects keep emerging entertain us.

One such project is Raft Finance, which is launching a new stablecoin, $R.

R is interesting. It’s crypto collateralised like $DAI, but it’s only collateralised by one crypto asset - staked ether aka $stETH.

Like others in the space, it seeks to maintain parity to the dollar through a set of incentive mechanisms.

According to @the_datanerd in their new dashboard:

“R further improves the design principles introduced by SAI (Single Collateral Dai) and LUSD. R features increased capital efficiency, flexible fees, more efficient and instant liquidations, and a more robust incentive and soft peg mechanism”

Let’s see what else it says…….

Users can borrow a minimum of $3000 in R by adding $stETH collateral, while keeping all their $stETH yield.

The current supply is almost at $17 million, having grown almost 3 million from yesterday:

(Note that the large majority is held by a single wallet)

While the circulating supply shot up yesterday and today, the protocol TVL grew more slowly throughout the week and now sits at ~$26.6m:

There are already 3 DEX pools, 2 on Balancer V2 and one on Uniswap V3.

TVL of the pools currently sits at:

R/DAI ~$11.5m

R/wstETH ~$23.68m

R/USDC ~$135k

DEX volume has slowly grown over the past week, now exceeding $4.7 million!

Raft is still new, and only has 15 holders, with the biggest wallet holding over $16m…….

It’ll be an interesting project to keep an eye on, no doubt. Check out the full dashboard for more.

(There’s also a great new dashboard by team @impossiblefinance, and another by @dcfpascal)

ERC-6551

Every crypto enthusiast will instantly recognise ERC-20 as Ethereum’s classic fungible token standard, and ERC-721 as the equivalent for NFTs.

There are other less famous ones, including an exciting new entrant, ERC-6551.

ERC-6551 improves on the ERC-721 standard by adding smart contract capabilities to NFTs in so-called “tokenbound” accounts.

A tokenbound account is like a special NFT that can hold other assets, interact with other entities onchain, carry out transactions and enter into contracts.

To learn more about the new standard, check out this interesting thread.

A new dashboard by @sealaunch explores this exciting frontier.

So far 360 of these accounts have been created:

These accounts have performed 217 transactions, the vast majority of these occurring during the first week of June so far:

The dashboard also lets us see which NFT projects have been utilising the standard so far.

Apart from a few little-known projects like Sapienz and LOM BABY, it is still in its infancy:

It’ll be interesting to follow this new token standard and see if it helps to bring the long awaited “utility” to NFTs.

@sealaunch are real NFT experts, and they certainly seem bullish on this new category:

Take a read of their thread.

You can also read more about ERC-6551 here, and of course check out the full dashboard for more data.

More Dashboards

GN

Thanks for reading, and special thanks to the Wizards who contributed their insights and analysis.

We’ll see you again next time for more data, dashboards and Wizardry.