Dune Digest #82

NFT Marketplaces, MagicEden, Account Abstraction, Swoosh & more!

GM

Welcome to issue #82 of Dune Digest!

Let’s get straight into this week’s data.

The NFT Market Slows

The wider NFT market has had a rough time over the past year, but recently it has slipped to all time lows.

Depending on who you ask - JPEGS are either dead or have finally bottomed out before the next boom…..

Let’s investigate the recent trends through a legendary dashboard by the one and only

We’ll look at some high level metrics. Firstly volume.

NFT marketplace volume peaked in 2021 and the first half of 2022. Since then it has been on a steady slide.

OpenSea volume never even started to recover, and although the launch of Blur did give the entire market a boost, this hasn’t been decisive and the trend is reversing in recent weeks.

On the subject of Blur, everyone knows that they’ve been using the bear market strategically to take marketshare and position themselves for the next bull run.

This dashboard really highlights how big Blur has become in 2023 though. Winding back to early 2022 OpenSea were capturing 80%+ of total volume. This slid through 2022 with Gem, Blur and X2Y2 taking marketshare - before Blur burst onto the scene around 8 months ago.

Now Blur is taking ~60% of total volume.

But at the moment, Blur is taking a larger slice of a shrunken pie.

This isn’t just in volume terms. Though prices were way down, many commentators took solace in the user and transaction data holding strong.

This was true until the last 3 months or so. Since late March weekly trades across marketplaces have dropped from 600k+ to ~120k in recent weeks.

Again this metric was buoyed by Blur’s rise, but has also reversed.

It’s a similar story when we look at traders. OpenSea still retains a strong lead here, but again the overall trend is bearish.

Over the past month, weekly traders have been at their lowest levels since July 2021. Last week there were only ~60k traders across marketplaces. Compare that to January which saw ~160k:

Overall the NFT market is at a low point by several core metrics. The positions of different platforms are also shifting significantly.

Is this the bottom? Or are there more dips to come?

Check out the full dashboard for more…..

Ethereum Users

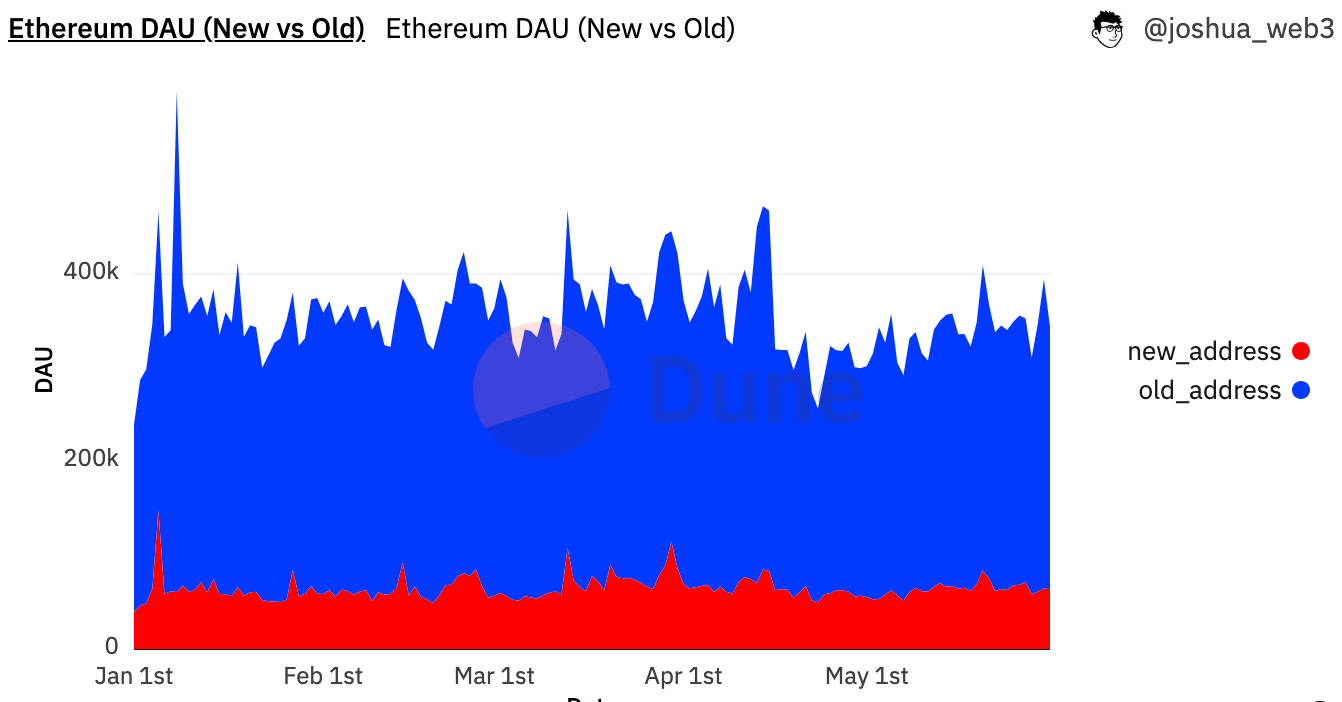

So pretty bleak figures for NFT marketplaces, but how about Ethereum in general. Let’s take a look through a new dashboard by joshua_web3.

Since January, we do see a slight slide in daily and monthly active users, and a more significant drop since May.

The trend is relatively subtle, and seems to be mostly driven by a dip in returning users, with new addresses remaining steady:

Another interesting metric is “stickiness”, measured by DAU / MAU.

Ethereum’s overall stickiness - the portion of monthly users returning daily - hovers at around ~5%, and has only briefly hit 10% in 2023 so far:

Overall, Ethereum continues to plug away with millions of monthly users.

There’s a lot more interesting data in the full dashboard, check it out.

Nike Doubles Down on NFTs

Nike had the most success of all the brands who jumped into NFTs in recent years.

They seem to be doubling down with the launch of their new .Swoosh web3 community platform.

Let’s take a look through a new dashboard by @web3academypro…..

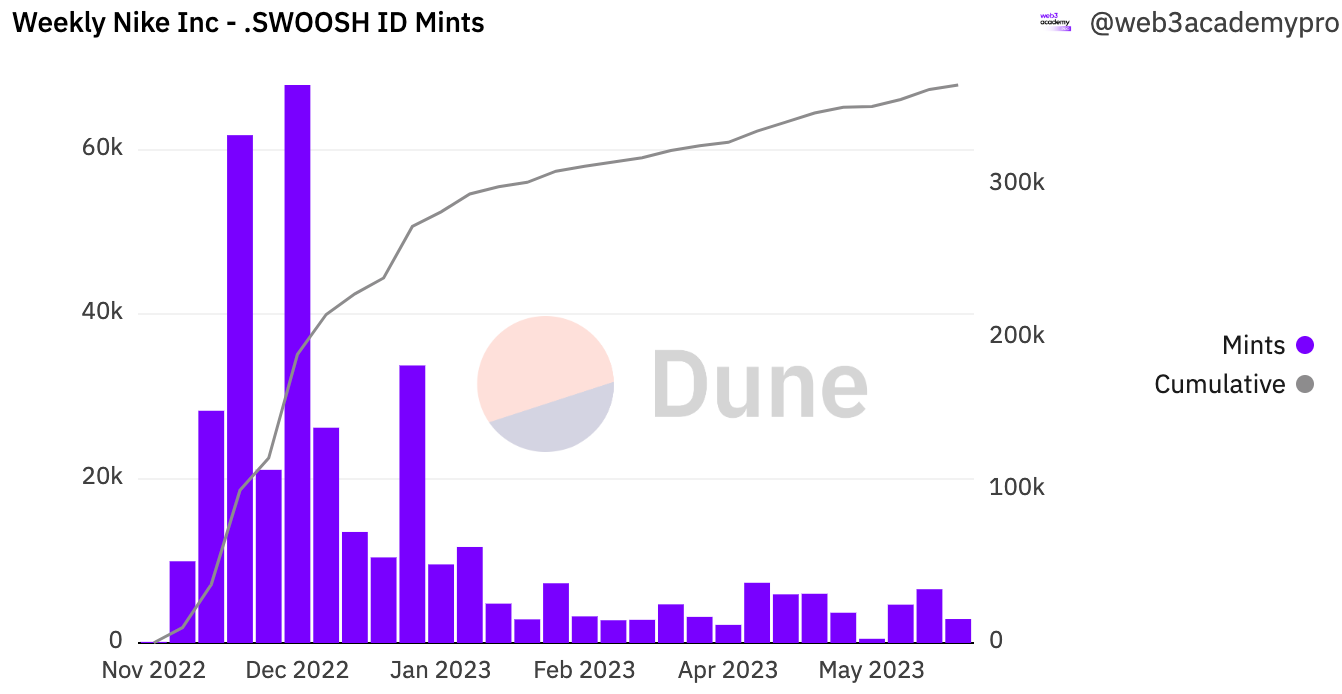

Users have been able to mint a .Swoosh ID since last November, and 365,564 IDs have now been minted.

This peaked back at the tail end of last year, but has continued at a steady pace of 3-5k weekly through 2023:

Recently Nike launched the first NFT drop on the platform.

The OF1 collection consists of two types of virtual sneaker NFTs: the Classic Remix sneaker boxes and the New Wave boxes, which are designed to pay tribute to the iconic Nike Air Force 1 sneaker.

They went on sale on May 15th, and so far 97,628 have been minted, bringing in $1,934,987 in revenue:

It is interesting to see the moves being made by these big players. Nike seem to see a strong future in NFTs and digital assets, so they’re particularly interesting to watch.

Check out the full dashboard for more.

Account Abstraction

Account Abstraction is a hot recent narrative in crypto. What does it mean? Essentially, account abstraction is a new set of standards that allow for “smart wallets”.

Traditionally in Ethereum you have two kinds of account - Externally Owned (EOA) and Contract. EOAs are controlled by private keys, while a contract is purely for executing logic.

Smart wallets promise to blend the two in some key ways, building the basis for a much better UX and new kinds of applications.

A new dashboard by @sixdegree gives some interesting stats. Let’s check them out.

So far 8,388 users have made use of this new paradigm, with over 21 thousand UserOps:

Clearly, this is still experimental, and over 88% of this activity is going down on Polygon.

Overall transactions have been rising significantly over the past few months, hitting a high today:

So it’s growing right now, and all going down on Polygon.

Check out the full dashboard for more!

MagicEden

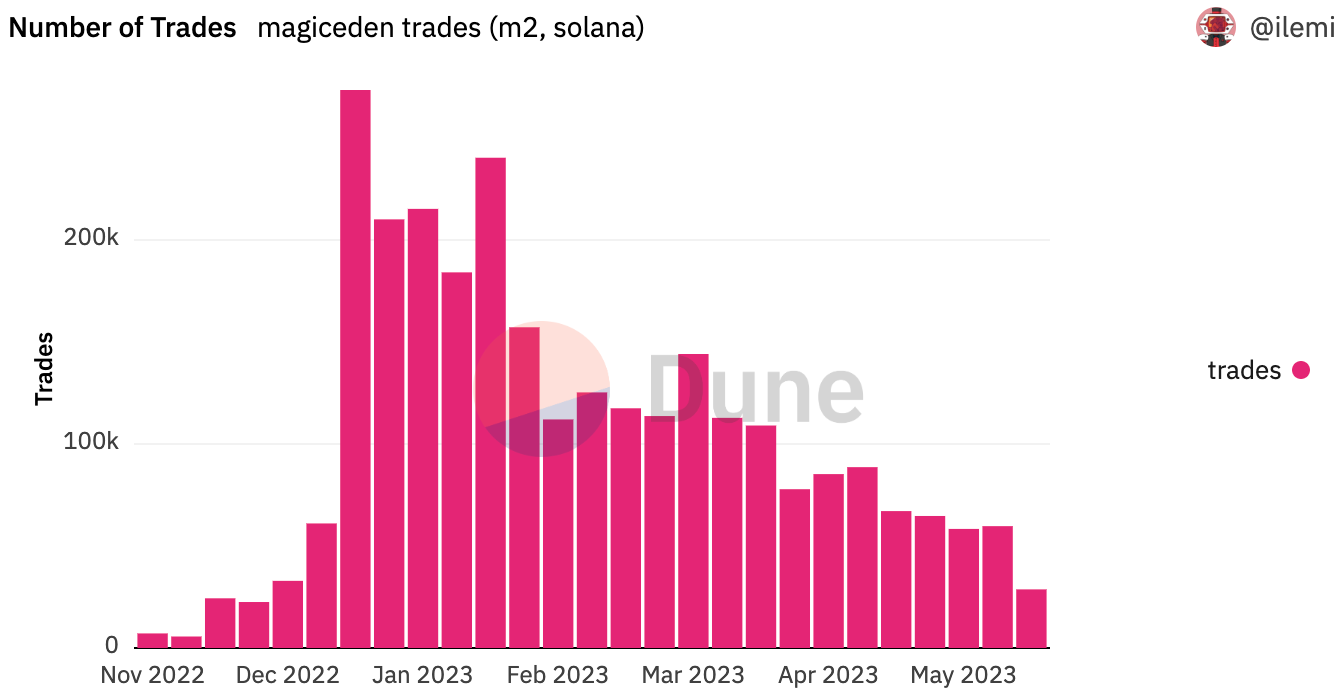

Now that we’ve upped our Solana data game, we can look at platforms like MagicEden in more depth. Let’s take a quick look at a new dashboard by @ilemi…..

MagicEden has seen over $228 million in total volume, and ~2.8 million trades.

Like the wider NFT market though, things have been slowing down in 2023 as weekly trades have dropped by almost 90% compared to the beginning of the year:

Volume in both $SOL and USD is on the same trajectory, dropping after a large spike at the beginning of the year…..

To learn more about MagicEden and get far more data, check out the full dashboard.

More Dashboards

GN

Thank you for reading.

We wish you an enjoyable weekend, and will see you again next Friday.

As ever, a special thanks to all Wizards who contributed to this issue!

Great