GM

Welcome to issue #78 of Dune Digest!

We have an action-packed issue full to the brim with data, dashboards & Wizardry for you this week.

Let’s get right into it, after a quick update from our product team.

What we shipped in Q1

Q1 was a busy time, and we were (as always) in shipping mode.

We released a ton of new features to make Wizards’ lives easier, from table previews to AI powered query explanations and much more.

We just published a product roundup for Q1 - check it out!

Now let’s get into the data

Blend

Though in the depths of a bear market, the NFT space is never short on surprises and hot new trends.

The biggest news this week was Blur’s launch of Blend, a portmanteau of Blur and Lend.

As you might have guessed, Blend is Blur’s new native P2P lending platform.

It allows collectors and traders to effectively buy NFTs “on credit” with a small downpayment, in a similar way one might buy a house with a mortgage or a car on a finance plan:

In Blur’s Twitter announcement, they highlighted how the feature opened up accessibility to blue chip collections, and features zero fees for borrowers or lenders.

Thanks to @beetle, we have a great dashboard tracking the action. Let’s take a look…….

Blend is less than one week old, but it has already seen:

1,445 loans

493 borrowers

409 lenders

A lot of $ETH has been loaned, equivalent to more than $36.4 million:

The loan volume itself, along with total loans, peaked on launch day. This has dropped a little throughout the week, but is still going steady:

Right now there’s 449 active loans worth 4.84k $ETH!

Which NFTs are people buying on credit?

Blend currently supports 3 collections - Wrapped CryptoPunks, Azuki & Milady.

Miladys are currently the most popular with 209 loans, while Azukis have accounted for by far more volume.

Punks have seen relatively few loans, but by far the highest average loan amount at over 46 $ETH:

The Blend protocol could allow plenty of other loan types in the future.

This has quickly become a significant part of the platform, accounting for 20-50% of Blur’s overall volume through the past week:

There has been some interesting speculation and debate over the past week about the implications of this.

What we know for sure is that Blur shipped another well-executed launch, and continues to innovate in the NFT space.

Check out the full dashboard for much more data.

BRC-20

We’ve all heard of ERC-20 tokens, but have you heard of BRC-20?

BRC-20 is a new token standard…. on Bitcoin. The experimental, fungible token standard leverages JSON data in ordinal inscriptions to create, mint and transfer tokens.

The mastermind behind BRC-20 tokens is Dune Wizard @domo!

With a new dashboard by @cryptokoryo, we can peer into the crazy recent action with BRC-20, so let’s go.

BRC-20s started to really take off over the past 2 weeks, peaking at ~366k transactions on the 1st of May alone:

In total now, there have been over 2.7m BRC-20 transactions, generating 135 $BTC in fees for miners.

As you might have guessed, this is huge.

BRC-20 transactions are the large majority of Ordinal transactions.

Not only that, but BRC-20 transactions are now impacting the entire Bitcoin network significantly.

In fact, last Sunday & Monday BRC-20 transactions were over 50% of all Bitcoin transactions:

BRC-20s were also driving ~30% of total daily Bitcoin fees!

This is a double edged sword in some respects. Yes more fees is great for miners and network security, but it isn’t for day-to-day Bitcoin users.

Fees have spiked across the board:

BRC-20 is very interesting, and could have an important future as part of Bitcoin’s evolution.

To learn more, and to get more data, check out the full dashboard…..

We also recommend this informative thread by @tomwanhh.

Arbitrum

Arbitrum is going from strength to strength in 2023 so far, according to a new dashboard by @biteye.

Daily users have increased markedly from February, and have been regularly exceeding 200k over the past month:

There have been almost 14 million active users over the past 90 days - not bad at all!

When it comes to transactions, it’s a similar story.

They’ve been growing noticeably in recent months, consistently topping 1 million per day and hitting ~115m over the past 90 days:

A lot of these transactions are DEX trades, the DEX market on Arbitrum is certainly lively.

Players like Kyberswap, Sushiswap, GMX & Dodo have been vying for volume and users since the early days of Arbitrum, but in recent months the market has shifted.

Uniswap started off 2023 in heavy competition with the other leading player - Sushiswap.

Over the past ~6 weeks though, Uniswap has increasingly started to dominate, accounting for ~70% of users and transactions.

Uniswap’s multi-chain expansion continues apace.

Check out the full dashboard for more…..

Crypto hacks, a history

We all know that crypto is the wild west of finance.

This is a double edged sword. There’s a ton of innovation, opportunity and excitement - but like the original wild west there is also lawlessness and risk.

It’s rare that we feature 2 dashboards by the same Wizard in a single Dune Digest issue, but this week is an exception.

@cryptokoryo has build a dashboard using off-chain data that explores the history of hacks, scams and rugpulls in crypto.

Let’s look into this infamous history…….

Firstly let’s look at the top 30 hacks, worth a staggering $5B+:

Ouch.

Some of the biggest in recent history have been Poly Network ($611m), BNB Bridge ($586m), and Wormhole ($362m).

The biggest of all occurred when Axie Infinity’s Ronin Network was hacked in March 2022 to the tune of $624 Million!

In-between these large hacks have been dozens of “small” ones in the tens or hundreds of millions……..

Out of these top 30 hacks, ~60% were on unaudited protocols.

Out of the remaining 40% though, many were audited by big names:

Now lets move on to the notorious rugpulls.

A rugpull is when fraudsters hype up a project to attract investors - before pocketing the money and disappearing.

Financially speaking, rugpulls are on a lower level to hacks - with ruggers pocketing a little over $200m…..

One of the largest rugs was the infamous AnubisDAO, which fleeced victims to the tune of $60m.

Other notable incidents were Meerkat Finance ($32m), Paid Network ($27m) and StableMagnet ($27m).

There are 3 popular methods of rugpull:

Drain Contracts (68.8%)

Infinite mint & dump (13.5%)

Drained contracts & wallets (13.5%)

Other less common rugs include drained vaults, router exploits and redirected deposits.

72.5% of rugged projects were never audited…..

Rugs on Ethereum cost users the most ($102.9m), followed by BNB ($72.1m) and Avalanche ($18.1m):

In 2023 so far, $276.4 Million has been lost to hacks, of which $213m was on Ethereum.

The majority of this - $197m - was hacked from Euler Finance in a flashloan exploit. The hacker later made efforts to return much of the stolen money.

All in all, DeFi protocols still need to do a lot more to ensure security for their users. We’ve seen that many don’t even get audited - but even if they do, that’s by no means a guarantee of safety.

Clearly, the hacks and rugpulls will continue until standards improve.

Check out the full dashboard for much more.

Polygon NFTs

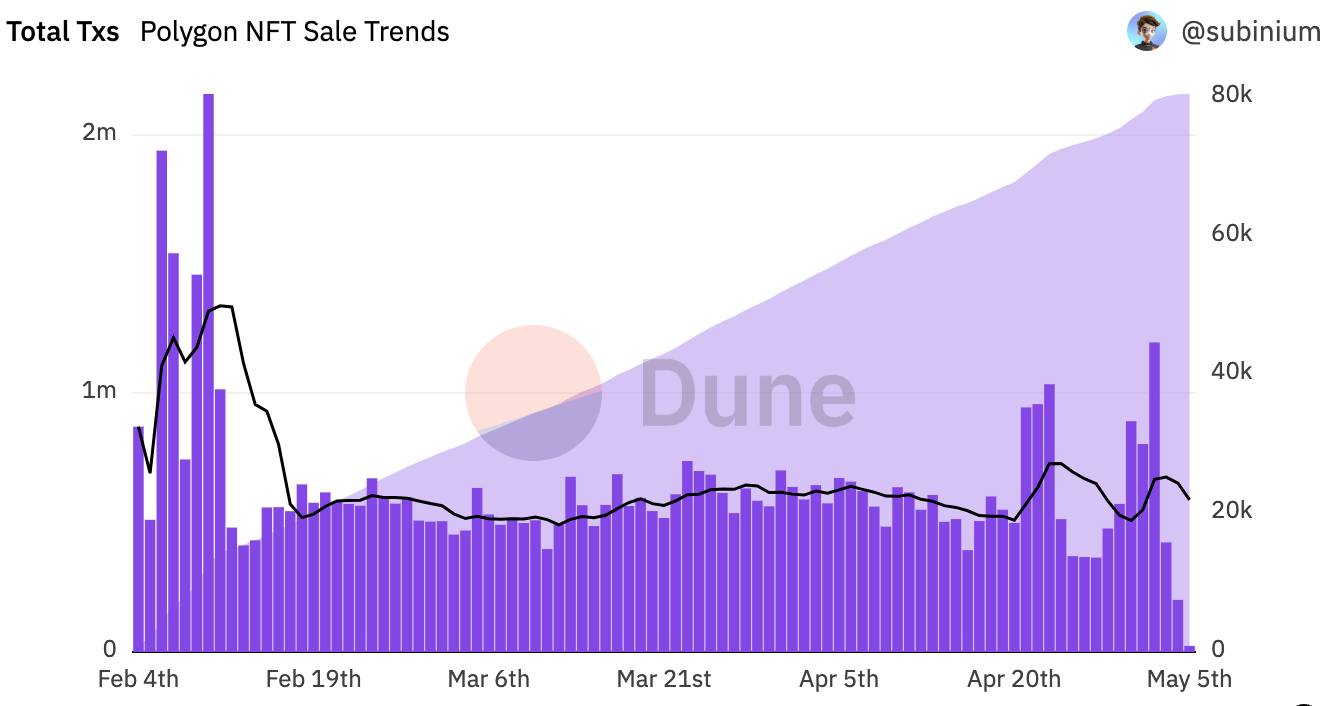

Over the past couple of years Polygon has become a hot destination for NFT projects on the experimental edge. A new dashboard by @subinium looks at the Polygon NFT ecosystem in depth, lets look at the highlights…..

Over the past month, Polygon has seen ~672k transactions and ~164k buyers - for a total volume of over $22 million.

This is coming off a large spike in transactions & volume a couple of months back in early February. Since things cooled off - core metrics have been stable:

One metric though has been climbing - the number of projects traded daily. This reached a high in late April, and is a positive indicator for the overall ecosystem.

Though OpenSea has been challenged on Ethereum, on Polygon it maintains a dominant position - accounting for ~90% of transactions and ~95% of volume.

Slowly though through 2023, MagicEden, Aavegotchi and recently Tofu have all started to grow their slice of the pie:

According to the Reservoir data @subinium analyzed, most trade happens in $MATIC - Polygon’s native currency - with a sizeable minority in $wETH.

To learn more about the Polygon NFT market, check out the full dashboard.

More Dashboards

GN

Thanks for reading - and a special thanks to all contributing Wizards.

Have a great weekend and see you again next week.

672k transactions wow

Good project