Dune Digest #55

FTX Blowup, Web3 Social, MetaMask Bridge & More!

GM

Welcome to issue #55 of Dune Digest!

It has been a heavy week in crypto. What can we say, it’s a crazy industry, and still the wild west on the technological and legal frontiers.

We’re going to be reflecting on the week’s events shortly, but first a little Dune News.

Meetups

DuneCon in September was a huge success. We loved hanging out with the Wizard community.

So, we’re going to be doing a lot more - all around the world. They’ll be a great chance to:

Socialize with fellow Wizards

Network with fellow degens

Meet the team

Get your questions answered

Show off your work

We’ve got a bunch coming up over the next few weeks, from Berlin to Bangalore:

Go ahead and register for the meetups, and stay tuned on Twitter for the Wizard drinks:

See the full lineup here, and join the IRL community here!

How do we think about paid products?

Dune is evolving as a product in a rapidly evolving industry. But we’ve always thought about paid products in a certain way.

CEO & Co-Founder Fredrik Haga explains in this article.

Now, let’s get into the week’s data…….

FTX & Alameda Blowup

Since launching in Summer 2019, FTX rose to become one of the largest crypto exchanges in the world.

This week, it imploded.

Dune Wizards have been at the forefront of breaking news & insights. We’re going to take a quick tour through the timeline of the key events, using some great dashboards for illumination.

So what initially caused a meltdown of the #2 crypto exchange?

Fittingly, a Tweet from the CEO of #1…..

Let’s cut a long and complex story short.

Over a week ago Coindesk published a piece raising questions about FTX’s “sister” trading firm Alameda, whose balance sheet they alleged was overweighted in $FTT - FTX’s relatively illiquid native token.

Alameda was using $FTT as a backstop.

Fast-forward through some damage control and assurances, and enter Binance.

Binance were early investors in FTX, making $2.1B from cashing out equity which they took in $FTT & $BUSD.

The tinderbox was sparked when CZ announced the liquidation of Binance’s $FTT holdings - “in a way that minimizes market impact” (lol).

He added fuel to the fire by subtly comparing FTX to Luna and publicizing a $584m $FTT transaction.

Investors were spooked enough at this point to cause a bank run as they rushed to withdraw funds.

As we can see from this query by @haoyssss, last weekend 360 Thousand $ETH, worth almost $600m, was drained from the platform.

ERC-20 balances were next up, with around $1 Billion pulled since the infamous tweet:

There was also a stablecoin exodus of 95%……

A dashboard by @thea tracks net flows from known FTX addresses. Net outflow has significantly outpaced inflow since November 1st, peaking last weekend:

This has left a hole of over $1.65 Billion:

On Monday with $FTT hitting a liquidity wall, Caroline Ellison, CEO of SBF’s nominally separate trading firm Alameda Research, offered to buy all Binance’s tokens at $22.

This may have given some short-lived relief, but it didn’t last.

The price of $FTT crashed as holders rushed to unload and buyers were MIA - losing 90% of its value according to this query by @kapurs:

The next stage of the drama was CZ announcing plans for an emergency takeover of FTX by Binance.

Though a letter of intent was signed, the deal fell through shortly afterwards.

Relief from other parties is now unlikely. This looks like the end for FTX after a dramatic & rapid collapse.

It seems that the actual hole is far bigger than most people imagined, that customer funds have been misappropriated, and that Alameda and FTX were resting on a house of cards that one Tweet was enough to topple.

FTX was a black box. One silver lining is that exchanges from now on will be under increased pressure to make their reserves public and transparent.

CZ himself proposed that:

"All crypto exchanges should do merkle-tree proof-of-reserves"

We can already take a look at the lower bounds of Binance’s reserves on Ethereum through a new dashboard by @21shares.

Their total balance is at over $42.55 Billion:

Approximately half of that is held in $BUSD, $6b in $ETH and Billions more in various other coins.

Note that this is only on Ethereum, they have significant reserves in other assets like $BTC……

Another good example of on-chain proof-of-reserves is Kucoin, demonstrated in this dashboard by @beetle.

There are also calls for a renewed focus on actual DeFi as opposed to CeFi.

Truly decentralized protocols, fully on-chain and open for Dune Wizards to audit, are more open, transparent & robust.

In our opinion, they’re still the future of finance.

This chain of events is a saga that whole books can and will be written about, and what we’ve covered here is only a tiny snapshot of what went down.

There are countless pieces of context, lurid details, & speculative theories we’ve had to omit.

To dive in further, here are some relevant dashboards that were trending this week:

Stay safe everybody!

Reddit Avatars World Cup

Let’s move on to some more lighthearted news, Redditors and their PFPs.

We covered them a few issues back and were startled by their success at onboarding millions of the platform’s users into NFTs.

But is it sustainable? Will users stick? A new dashboard by @satsih investigates……

Over 3 Million wallets hold over 3.1 Million Reddit avatar NFTs:

For almost 98% of users - it was their first Web3 interaction. Huge!

There was a surge of minting and trading in late August, but that fizzled through September and October to a trickle by November.

We all thought it was fizzling out. Yesterday though, there was a large spike……

The reason? The Reddit World Cup!

This week Reddit dropped over 8 Million more soccer-themed NFTs on Polygon.

Users have been rushing to snap them up, with over 170k minted and over 32.1k sales so far.

Users can mint player avatars from different countries. So far Brazil, England & Argentina seem particularly popular - and 271 wallets have managed to mint from all 33 countries!

Reddit is doing interesting work with this, proving that NFTs can be fun, and can appeal to Millions of people if done right.

Check out the full dashboard for more.

Web3 Social Adoption

While it’s all doom and gloom in CeFi & DeFi land, there’s a small but growing group of builders creating the next-generation of social & credentialing apps on Web3.

We’ve covered a few individually before, but came across an interesting new dashboard by @denze that covers all the key players in one go. Let’s take a look……

The dashboard analyzes 15 protocols in total - on Ethereum, Optimism, Polygon & Gnosis:

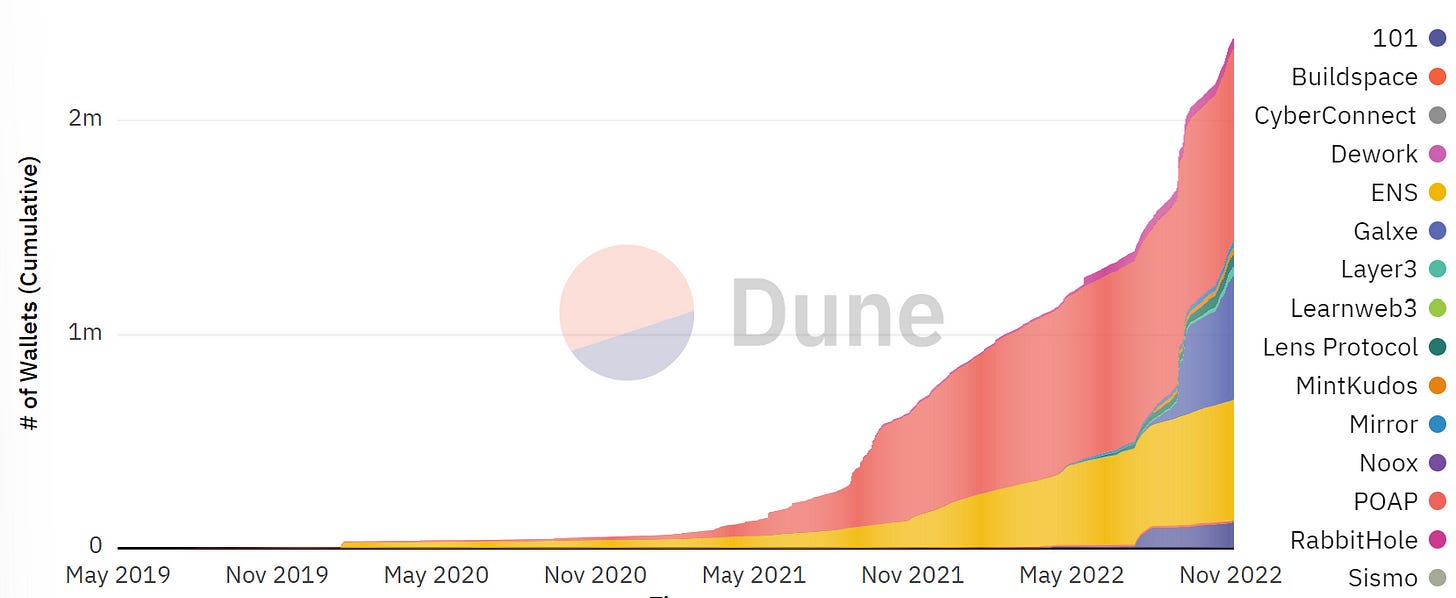

Collectively, these protocols have onboarded 2.26 Million users. The top 3 account for over 95% of users:

POAP - 982.1k users

Galxe - 679.2k users

ENS - 546.8k users

POAP gives users NFT badges that prove attendance of virtual or irl events, Galxe is focused on on-chain credentialing, and the ENS provides the .eth names we all know and love.

Though these three dominate, there are several others that seem to be doing well with significant usage like Layer3, Rabbithole, Mirror & Lens:

POAP has been around since 2019, before ENS burst on the scene in a big way in early 2020. This year though, the diversity of projects really blossomed - with newcomers like Galxe (in particular) rising to prominence:

Through 2022 users started to adopt them in larger numbers, and the past couple of months have been particularly impressive:

It seems that the social Web3 space is thriving, and is in an innovative building period.

The fact that over 2.2 Million have already embraced these projects is an encouraging sign…..

Perhaps the next cycle, whenever that comes, will feature them prominently. Check out the full dashboard for more……

MetaMask Bridge

The leading Web3 wallet provider is in shipping mode recently.

This week they released MetaMask Bridge, a feature that allows users to bridge assets to multiple chains from within a wallet.

Let’s examine through a new dashboard by @Marcov….

Users can bridge between 4 chains so far:

Ethereum

BNB

Polygon

Avalanche

So far, Polygon has seen the most volume, users & transactions:

8,038 wallets have made 13.37k transactions - with total volume topping $4.5m:

An interesting feature to add and it’s only 3 days old. We expect it to see a lot of usage in upcoming months.

Check out the full dashboard for more…..

More Dashboards

GN

Thanks for reading, we hope you enjoyed it. As always, a special thanks to all the Wizards featured for your razor sharp analysis.

We know it can get rough out there in this industry, and bear market gloom can take its toll.

If you lost money this week, we are truly sorry…….

Big changes for the industry are on the horizon, along with major risks and opportunities.

The Dune community is going to be there for you with the latest data, dashboards & Wizardry throughout, no matter what happens.