Dune Digest #54

Uniswap MEV, Lens, AVAX, Metamask & More!

GM

Welcome to Issue #54 of Dune Digest!

Some crazy dashboards to cover this week. Firstly though, some exciting news…..

GitPoaps for contributoooors

GitPoap validates contributions to open source projects by combing Github repos for merged PRs.

Their POAPs are proof of work for contributions, recognized by most on-chain credentialing systems.

We’re excited to partner with them to bring on-chain recognition to Wizards. If you’ve had a Dune PR merged, you’ll be eligible, go ahead and mint one.

You’ll get a special role in Discord and future perks TBC. They also look pretty cool:

If you’re interested in contributing to Spellbook yourself, check out how to get started!

In other news - the Dune team met up with Wizards this week for drinks and snacks in both Lisbon & San Francisco. If you were there, it was great to meet you.

Now, let’s get into the data……

The MEV Game is Changing on Uniswap

“Everyone's heard of MEV before, but how many people actually understand it? For some it’s scary, for some it’s sexy, for some it's money”

This snippet is taken from the intro to @jhackworth’s latest dashboard covering MEV on Ethereum.

He’s right, MEV can seem like an unintuitive and opaque “dark art” of the crypto world. Thankfully, since we integrated Flashbots data, we can peer in a little with great dashboards like this. Let’s take a look.

Firstly, MEV is big business…….

MEV searchers have collectively made more than quarter of a Billion in profit:

Some of the largest arbitrages have netted several million in profits from a single event, & the most successful searcher made $39m alone!

So are they all raking it in? Not quite.

There have been over 2.71 Million MEV related transactions by 2726 searchers. The average profit per trade is under 100 bucks.

According to @jhackworth:

“For most arbitrages, the total profit is not that great. 90% of trades earn less than $113 dollars in profit on a trade. Only 1% of MEV arbitrages earn more than $1000 on a given trade”

Just 13% have made >$50k profits…….

It can also be risky. The worst MEV attempt resulted in a $2m loss (ouch), and 39% weren’t profitable at all.

Like most things in finance, the dynamic is governed by an iron power law with the rewards all going to the very top performers.

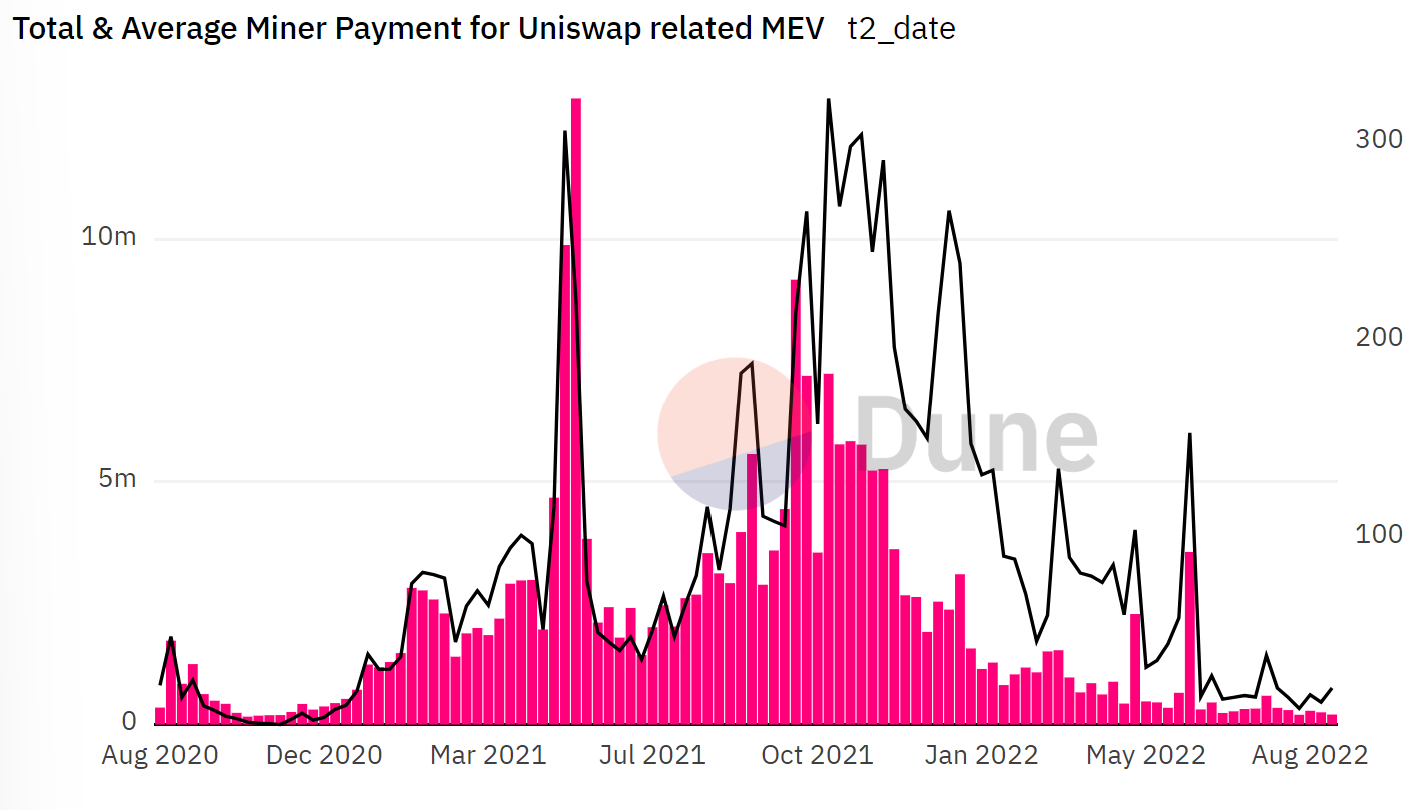

One of the reasons it can be hard to turn a profit is the need to “pay off” miners, who historically have skimmed an average of $81 on MEV transactions and pocketed almost $230 Million in total.

Many made profitable trades, but ended up making an overall loss because they paid more in miner fees.

Miner payments peaked in 2021 and declined through 2022 as Uniswap V3 launched with better slippage protection:

According to the dashboard, arbs in general have also been decreasing along with profits, this year dropping by more than 50% compared to 2021:

Though MEV does seem like it’s on the decrease, it’s still a relatively big part of Uniswap.

Over 26% of all blocks that involved Uniswap included MEV activity, which made up around 5% of the platform’s total volume.

Uniswap is also the key place for MEV.

Over 97% of all MEV activity on Ethereum has been associated with either V2 or V3.

It seems like MEV is changing though. @jhackworth looked into what MEV bots are up to post-merge and found some interesting patterns.

Since The Merge, MEV bots have done over $22.8 Billion in volume:

And their share of total Uniswap volume seems very high, 30-50% of the total over the past few months:

This is while they’ve accounted for “only” 5-10% of swaps during the same timeframe.

So MEV swaps tend to be much larger than the average user’s. The biggest swaps certainly present the juiciest opportunities for the bots, who in turn provide a crucial contribution to overall Uniswap volume and LP fees.

MEV distribution post-merge is also shifting. While Uniswap has seen 95%+ of bot activity historically, recently around 20% of volume has been going through other platforms.

Notable is the DODO DEX accounting for over 10% of MEV volume, @jhackworth takes an educated guess that the platform may have low liquidity:

There’s also a new MEV strategy in town - Just in Time Liquidity (JIT).

@jhackworth explains that JIT is:

“When MEV searchers look for large pending swaps and provide liquidity to the pool before the swap is confirmed. This allows the searcher to gain a cut of the LP trading fee and then removes the liquidity in the same block”

JIT trades are, on average, 5x more profitable than traditional arbs.

They’re still a tiny slice of the pie though with 13.5k attacks and a little over $2.3m in total profits.

There are fewer JIT opportunities, and they involve a higher degree of sophistication. It seems that only a handful of MEV searchers have the capability.

So far….. JIT activity is exploding over the past 6 months, and reached new highs in October:

One bot alone made over 86%+ of the total JIT profits!

One thing is certain, MEV is a fascinating topic. Uniswap is also the place to investigate it - through our Flashbots data of course!

This dashboard does a great job of examining the shifting nature of MEV, and giving us food for thought about its future. The strategies may change, profit margins can go up and down, but it seems like there will always be an army of smart opportunists exploiting the DEX model for all it’s worth……

Check out the full dashboard for more.

Avalanche in Q3

Over the past year, Avalanche has been establishing itself as an important L1 and component of the wider crypto ecosystem.

How did the platform perform in Q3? Thanks to a new dashboard by @chaininsight we can find out, let’s look at the key metrics…..

Avalanche had over 33k daily active users on average from July to October:

Together they made over 17.1 Million transactions.

Active users peaked in late July before trending down through the rest of the quarter:

43.7k new smart contracts were created. This activity also declined somewhat through late summer, but hundreds were still created daily through September.

These metrics seem correlated with the price of $AVAX itself, which peaked at almost $30 in mid August, but by late September had lost almost half of its value.

The platform made over $1.97m in revenue with an average transaction fee of just 12 cents.

NFT marketplace Trader Joe is in a league of its own on Avalanche, driving a significant chunk of overall volume & transactions, followed by GMX and a long tail of other projects:

Overall, Avalanche suffered along with the wider industry in Q3, but seems to have established a core, active userbase and several “killer apps” that are firmly entrenched on the platform.

Check out the full dashboard for more…..

Lens Update

Lens caused a lot of hype when it launched earlier this year, exciting people with the prospect of a decentralized, crypto-based social media platform to connect communities.

We covered Lens when it was in its infancy, but now it’s time to check in on the key metrics - especially since FTX Ventures today announced an investment in the protocol.

@iamyakuza put together a great Lens dashboard with some help from the forked queries of @gm365 & @niftytable - let’s see how it’s going.

The total number of profiles - an important metric for reaching a social critical mass - is approaching the 100k milestone:

How engaged have these users been so far?

Almost 40% - 37.3k - have made at least one post. That’s not a bad activation rate at all, but isn’t particularly impressive either given the novel nature of the platform and the fact that it appealed to a very specific userbase.

There have been 436.7k total comments so far, roughly 8 for every activated user, and 179k total comments.

Lens itself is a decentralized “social graph” protocol, with social apps built on top of it like Lenster, Lensfrens, Lenstube and hundreds of others. You can check out a list here.

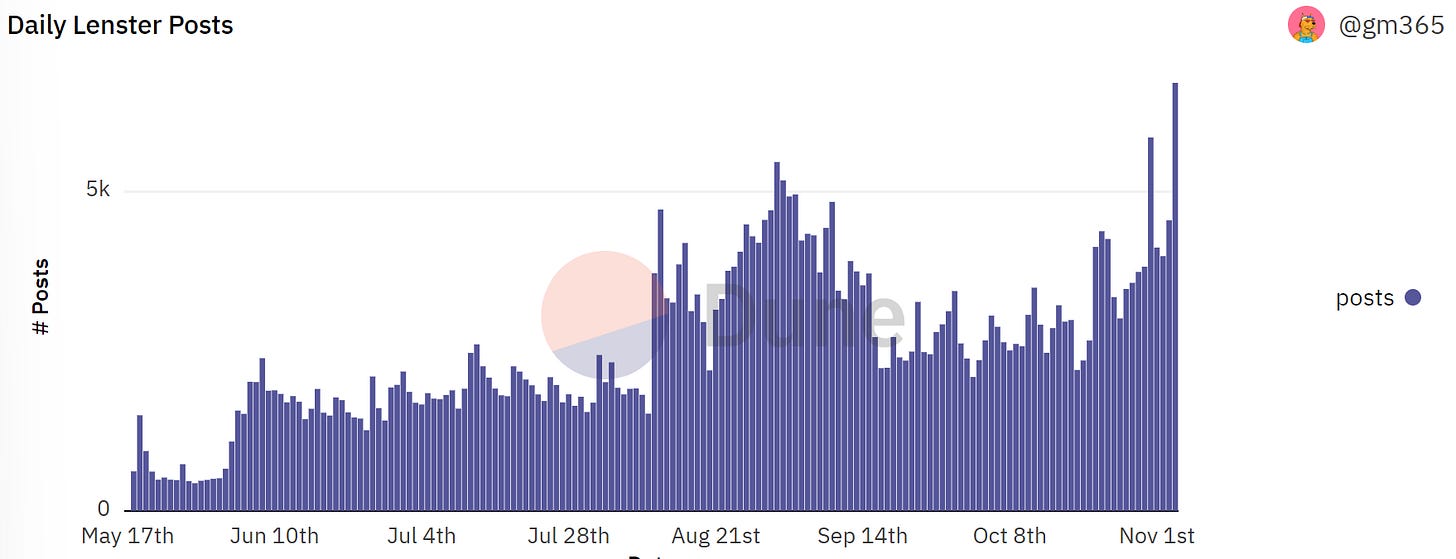

Of these, Lenster is the most prominent and closest to a traditional “social media” UX.

Posts are a good proxy for engagement, and Lenster has seen some solid growth since early Summer, and all time highs this week:

Lenster also seems to have built a core of hyper-engaged users, each one having made several thousand posts:

That said, only 10.9% of profiles have made >20 posts, and 80% have made less than 10.

Perhaps this is something that will grow naturally with the overall network effects of the platform, or perhaps it’s a sign that the onboarding & UX in general have room for improvement.

Is Web3 the future of social media?

It’s too early to say. But the cool thing about platforms like Lens is that they’re a great proof of concept. They work, they’re innovative, and they have real users finding value in them.

Now it’s “just” a question of scaling.

To learn more, check out the full dashboard.

zkBoB

There’s really a lot of interesting stuff being built on Polygon these days.

One project that caught our eye recently was zkBob.

Built with zk-SNARK tech by (some of) the team behind Gnosis Chain, the protocol allows private & anonymous stable coin transfers.

A new dashboard by @maxaleks breaks it down, let’s look at the key stats…..

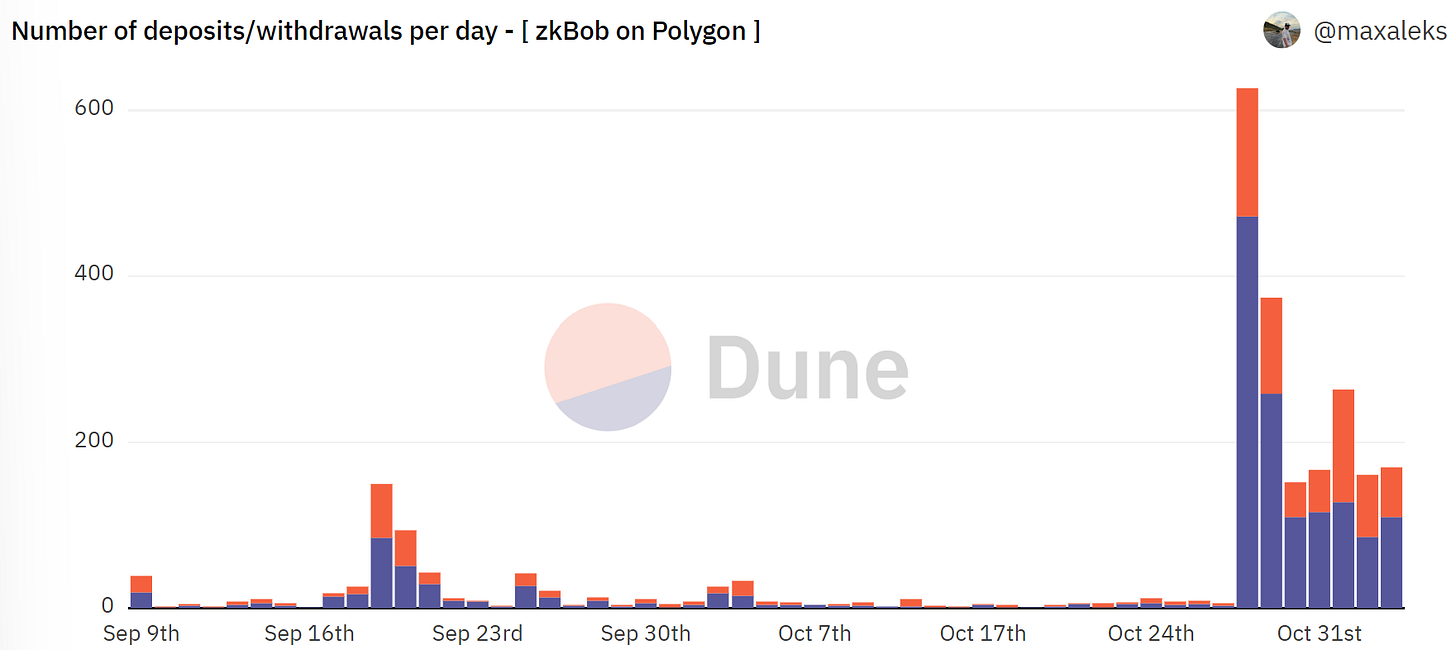

The heart of zkBob is the BOB stablecoin pool, which currently sits at over $217k:

1326 unique wallets have used the protocol so far, making almost 1700 deposits and over 940 withdrawals.

Not much was happening until last Friday, when all the core metrics really shot up before staying strong for the past week:

Almost half a million’s worth of BOB has been deposited in total, which seems like a good start for a fairly low-profile niche project.

It’s interesting to see another protocol leveraging ZK tech to bring robust privacy solutions to crypto. Privacy is still underexplored in this space, but there are plenty of solid teams working on the key problems.

Check out the full dashboard for more data.

Metamask DEX

Around 2 years ago Metamask launched “Swap”, a feature that combines data from multiple DEX aggregators and liquidity sources to allow users to swap tokens directly from their desktop or mobile wallets.

At the time, it was hailed as a useful UX improvement that might take a decent chunk of the wallet’s userbase deeper down the DeFi rabbit hole.

How did the experiment go? Pretty well, it turns out, as evidenced by a new dashboard by @subinium.

Over $50 Billion’s worth of trades have been facilitated through the platform:

1.43 million have made use of the service to the tune of 12.25 million transactions.

Hundreds of thousands were onboarded throughout 2021 and 2022. Users peaked one year ago in November 2021 at almost 175k, but declined through 2022.

They’re still going relatively strong though, seeing tens of thousands of new users per month since May’s market crash:

This also seems like it was a great business decision from Metamask.

Total revenue is at almost $450m:

That said, monthly revenue & volume have been declining fairly sharply since May:

This was an interesting vertical integration play from Ethereum’s most popular wallet.

It seems like it was largely successful, but will need to keep innovating and adapting to the changing market conditions and user needs to turn around the recent declining metrics!

Check out the full dashboard for more…….

More Dashboards

There were some unreal dashboards released this week that we didn’t have space to cover. Check them out for an extra data dose.

GN

Thanks for reading another issue of Dune Digest.

A special thanks to all the gigabrain Wizards for their contributions this week - amazing work!

See you next time, and enjoy your weekend.

cool

Just a remark, Fam. The POAP date is still showing the year 2021!!😂😂

And how can I collect mine?