Dune Digest #53

GMX, Chicken Bonds, Royalties & More!

GM

Welcome to Issue #53 of Dune Digest!

We’ve got a healthy dose of data coming up for you, but first a little news.

New Bounty System

This week we announced our new bounty system.

It’s going to run through “Web3’s Trello” Dework, an excellent tool for collaboration & project management.

Our goal is to make it simple for protocols & organizations to connect with the best analysts in crypto - and also to put more $ in Wizard wallets.

You can read about it in this thread, and in more detail in our docs.

Exciting times to be an on-chain analyst!

Arcana AMM Deep Dive

This week Dune’s @agaperste was joined by Uniswap’s Austin Adams for the latest live Arcana workshop.

They went on a deep dive into AMMs, covering a range of interesting topics through the on-chain data.

Need some light weekend viewing? Check it out!

Community Takes 🧠

@mausefalle dives into the crazy leverage being taken out on the Gains Network [link]

@CryptoEdgar has questions about the StepN treasury wallets [link]

@ZacharyDash breaks down the Flashstake protocol through @0xMurathan’s Dashboard [link]

@JDHyper investigates a recent exploit during the RTFKT x RIMOWA mint [link]

@Shogun examines the competitive landscape of Perpetual DEXes [link]

Now, let’s get DEEP into this week’s data……

GMX - the Decentralized Perpetual King 👑

GMX is a decentralized trading protocol specializing in perpetual futures. It’s notable for being native to L2, has launched so far on Arbitrum & Avalanche, and allows users to trade with leverage up to 30x.

Since we last covered GMX, it has gone from strength to strength. Let’s catch up with the protocol through a new dashboard by @Henrystats……

GMX has been proving that large-scale economic activity can happen on L2 platforms that were considered niche until relatively recently.

Trading volume is just off $70 Billion:

The majority of this comes from margin trading ($64.3B), with less than 10% driven by swaps.

Margin traders (50.2k) drive much more volume per user, since they’re actually outnumbered by unique swap traders (58.4k). All this activity has pushed GMX close to half a Billion in current TVL:

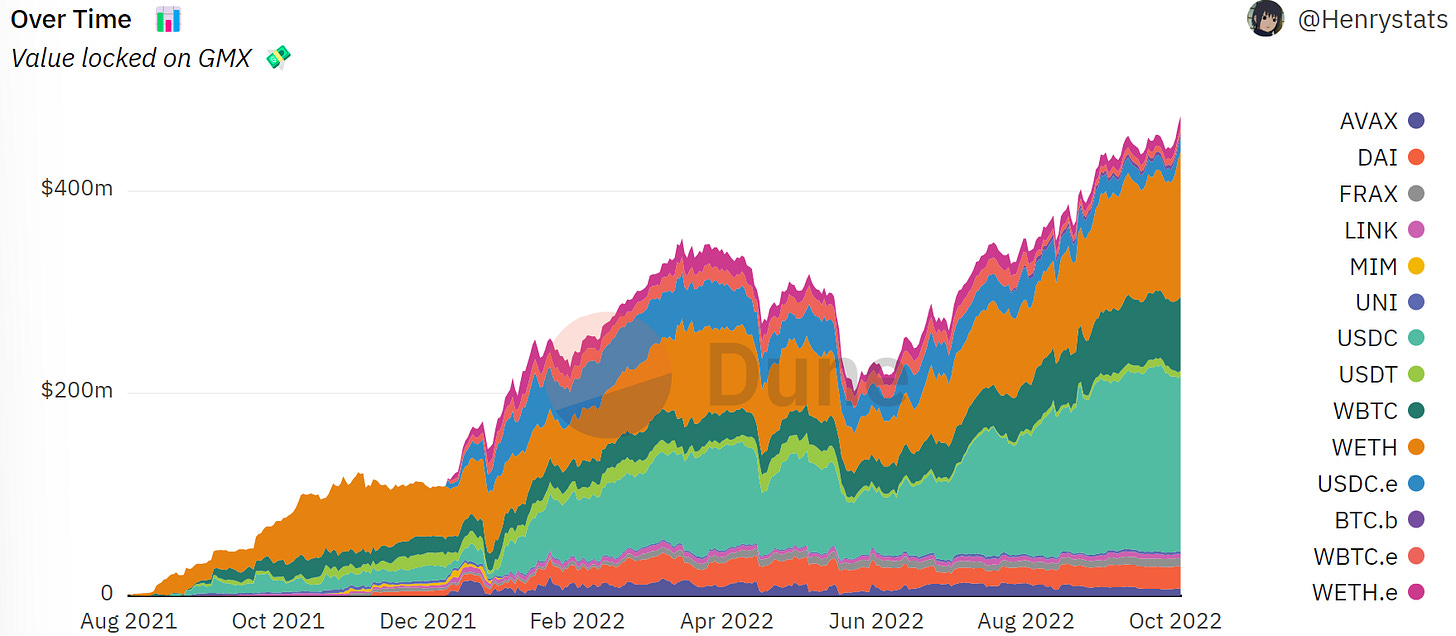

TVL grew steadily since Summer 2021 but levelled off and dipped after May’s market crash. Since then though GMX has defied the “bear market” and pushed to new heights through Q3 & Q4:

The past month has been busy.

GMX has seen over 6000 unique traders, 2.7k of whom are new to the platform. Over 10% of traders have been liquidated to the tune of $23.5 Million.

Tuesday was particularly bad for shorts, with over $20m liquidated in just one day as ETH pumped:

Ouch!

All this activity is generating a healthy amount of fees for both the platform and counterparties, which looks like it will cross the $100m mark some time soon:

GMX went live on Avalanche at the beginning of 2022 which quickly contributed significantly to overall volume.

Recently though Arbitrum has been pulling ahead accounting for 70-90% of trading volume & fees since late summer:

With tens of thousands of traders and Billions in volume, GMX seems to be solidifying itself as the cross-chain leader in margin trading.

This dashboard has tons more stats, check it out!

If you’re interested in the decentralized perpetuals market more generally, this dashboard by @shogun is insanely good also.

Chicken Bonds, Liquity’s Novel New Mechanism 🐔

A lot of DeFi can seem like new iterations, or to put it more bluntly - copies - of existing mechanisms and designs.

Earlier this month though, borrowing platform Liquity launched Chicken Bonds, which seem to be something new!

Chicken Bonds allow you to bond Liquity’s native stablecoin - $LUSD - and accrue $bLUSD rewards. So far, so normal, but there’s more…..

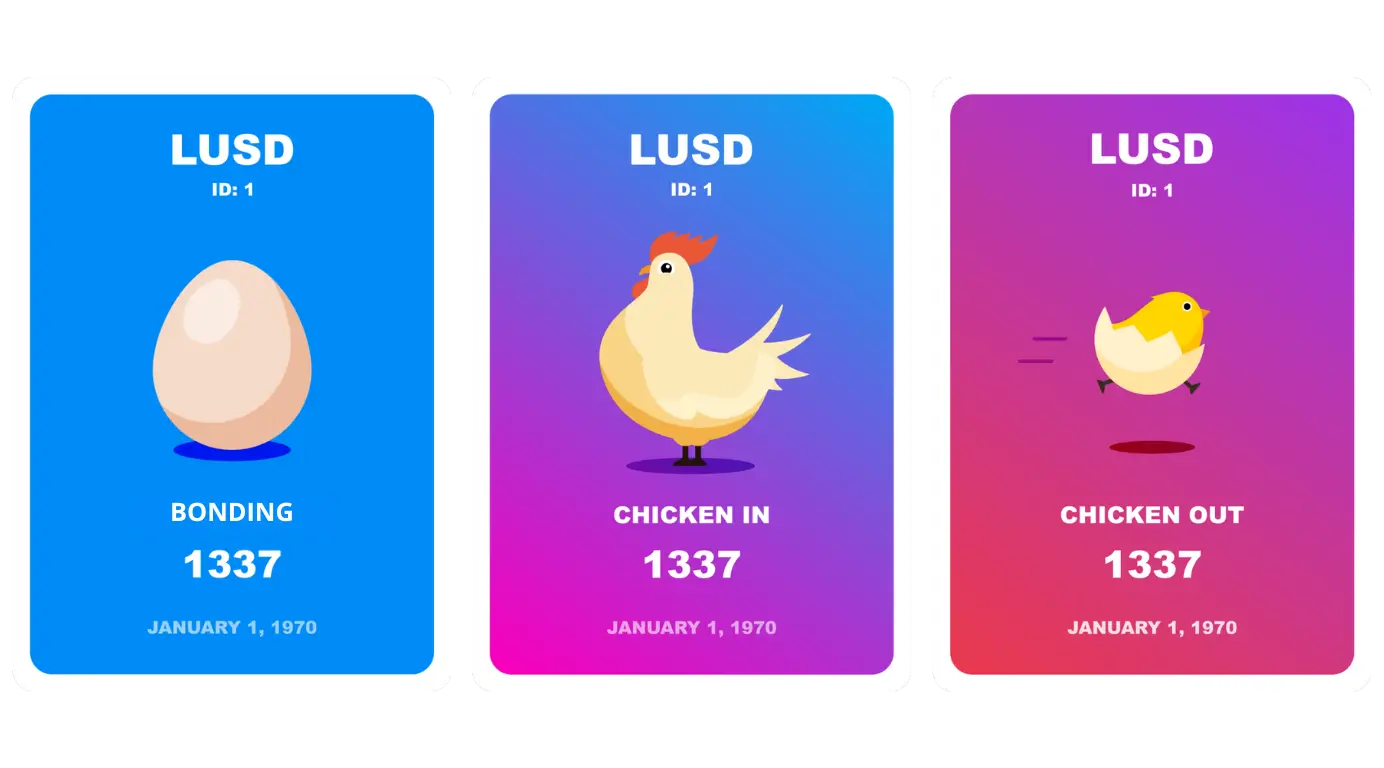

When you bond, you’ll receive a “dynamic” NFT that confirms ownership of the bond and is tradeable.

You can “chicken in” by making the bond permanent & redeeming your principal + rewards in $bLUSD, and also “chicken out” of the bond at any time you like, reclaiming the original $LUSD. The bond itself is indefinite with no maturity date.

Your NFT will change according to your actions:

The novel design has attracted significant interest so far, as demonstrated by a new dashboard by @nemoventures. Let’s take a look.

So far, over $23 Million in $LUSD has been deposited:

912 bonds have been taken out so far, with 82 chickened in and 63 chickened out.

This has been driven by 451 unique users who gradually arrived through October:

The $LUSD deposited has grown more rapidly over the past week by more than 2.5x!

Over 50% of bonds are in the $100-$5k range, but there’s a diverse range of sizes with 33 at $100k+:

Chicken Bonds are still young, but the amount of liquidity they’ve attracted so far is impressive. The mechanism is also an interesting one that we’ll be keeping an eye on.

Check out the full dashboard for more.

MakerDAO 🤝 Treasury Bonds

Venerable DeFi juggernaut MakerDAO is making some interesting moves lately.

Back in June, a proposal was put forward to diversify Maker’s balance sheet by leveraging $DAI beyond the cryptosphere.

MIP65 proposed moving $500 Million into US Treasury (80%) & Corporate bonds (20%), and after a months-long voting process was approved earlier this month.

According to MakerDAO this will:

“Promote the usability of digital assets in the traditional space, extending DAI’s influence beyond crypto.”

It should also improve their revenues.

Since this is one of the first cases of “real world assets” merging with crypto at scale, it isn’t easy to track on-chain.

@SebVentures managed it though, releasing a dashboard that attempts it….

As noted in the dashboard:

“In order to track this off-chain investment, a smart-contract on Polygon take record of ETFs operations and prices. This is more a proof-of-concept than production ready and shouldn't be relied on”

So with that pinch of salt, let’s see what the dashboard tells us.

Yesterday, the first large investment was made in US Government Bond ETFs:

This is split between:

IBTA: 1-3 year

IB01: 0-1 year

The portfolio is slightly weighted toward IBTA with a 60:40 split:

We can see that these investments were made in two transactions yesterday, with a few smaller transactions earlier this month:

There isn’t a huge amount of data to dive into so far, but this dashboard is an interesting proof-of-concept.

This investment sets a key precedent in the merging of crypto and the legacy financial system, and if it starts a trend we can expect more Dune dashboards covering real world assets.

Check out the full dashboard for more, and keep an eye on it for new investments!

Dework 🔨

Since we just announced our new bounty system that runs through Dework, it seems like a good time to explore the platform’s on-chain data. Let’s check it out through a dashboard by @pandajackson42.

Dework bills itself as:

“Web3 native Trello + web3 native Fiverr - productivity management for the contributor economy”

Dework allows organizations, teams & talented individuals to collaborate with each other, manage projects, and make payments.

One of Dework’s features is particularly interesting. When a task is completed, a non-transferrable NFT is minted on Polygon.

The NFT proves that the contributor has completed a task, and specifies the nature of the task in the metadata, so it can act like an on-chain resume.

It looks like a lot of work has been done on the platform so far, with over 20 Thousand NFTs minted:

These have been granted by 78 DAOs to 2930 unique contributors.

Dework has seen strong growth over the past 3 months, with total contributors growing more than 5x since early August.

This was thanks to huge spikes in daily contributors occurring in early August and early September:

October has been a slower month with a spike over the past week. We assume that as the platform onboards more DAOs and organizations, these peaks and troughs in usage will level out and become more consistent.

The other half of the equation is onboarding - and retaining - contributors themselves.

Dework seems to be doing a pretty good job of that too, with a fairly even new vs retained contributor split over the past several months.

During weeks with a low number of total contributors, retained contributors dominate - perhaps suggesting that Dework is building a core of contributors that stick around to get the work done:

Overall, Dework seems to be doing well as it finds product market fit.

We’re impressed with the platform and looking forward to hosting a ton of bounties there. Check out the full dashboard for more data.

Royalties on Magic Eden 💰

Magic Eden seems to have solidified its position as the dominant NFT marketplace on Solana.

A few weeks ago they controversially announced that they were making royalties optional on the platform. Let’s see what happened through a new dashboard by @ka_mo_ki.

With over 1.6 Million trades and $73.4 Million in volume over the past 30 days, Magic Eden is an important part of the Solana ecosystem.

Volume is way down since May highs. Actual users though, especially buyers, are growing nicely:

The NFT marketplace space is competitive and moves fast. Magic Eden has been dominant over the past year, but there are always rivals looking to undercut the leader and take their market share.

One way to do this is to cut royalties. A few of Magic Eden’s competitors, like Solanart, started to do this over the summer.

And perhaps it was starting to work. In this query by @kunal, we can see that Solanart was starting to bite into Magic Eden’s market share from mid-September:

You’ll also note that these gains mysteriously vanished around mid-October, at exactly the same time that Magic Eden themselves announced that they were making royalties optional.

From June to September, 90%+ of all trades involved royalties. For the first 2 weeks of October, royalty trades were 76-95% of daily totals.

Since they made them optional this has fallen off a cliff with zero-royalty trades making up 75% for the past 2 weeks:

This all suggests that if platforms can cut royalties to beat the competition, they probably will. The power does seem to be on the buyer side, and buyers themselves will (mostly) opt to not pay royalties if they don’t have to.

LooksRare announced this week that they were making royalties optional too - so this seems to be forming a broader trend…..

Take a look at the full dashboard for more!

More Dashboards

GN

That’s all for this week.

Thanks for reading, we hope you enjoyed it.

Even though we’re supposedly in a “crypto winter” - Wizards are pumping out just as many great dashboards as ever.

A huge thanks for all your hard work!

See you again next week for more data, dashboards & Wizardry.