GM

Welcome to Issue 30 of Dune Digest….. We’ve got an interesting issue for you this week, but first a little news.

We’ve launched our first bounties with OpenSea! These are some interesting and challenging bounties - check out all the details.

The best, most detailed piece ever written about Dune and the Wizard community is now available in audio for you to listen to at your leisure…..

Now, let’s get into the data.

Can Lens Disrupt Twitter?

Brought to you by the good folks at Aave, Lens protocol is a brand new primitive for Web3 social apps.

According to CEO and Founder of Aave, Stani Kulechov:

"We wanted to build a social media protocol, or essentially a social graph, and make those profiles on-chain, following the relationships on-chain and creating a permissionless way to distribute content between a creator and the audience."

Essentially, Lens enables users to create a profile as a composable NFT. These NFTs are tied to a wallet address and contain the user’s history of posts, comments and media content.

Owners of accounts can also choose how to monetize their content. For example, a follower can collect tradable “follow NFTs” from their favorite collectors.

Aave has referred to Lens as a “developer garden”, since it isn’t an app but a protocol that a new generation of social apps can be built on top of. Already, around 50 applications have been built on the platform, for example:

Aave unveiled Lens in early February, and announced the official Polygon launch this week.

@niftytable was fast with a dashboard giving us some high-level stats so far.

Right now, there are 8,528 profile owners, which had doubled by Thursday. The vast majority of wallets own a single profile.

What have these profiles been doing?

Some have started to rack up a following already with hundreds of followers:

When it comes to engagement, several posts have received 100+ comments and dozens of “mirrors” which is essentially a “share”.

2,809 posts have been created and more than 2,170 comments!

It is really exciting to see where this goes, and if Web3 has the power to truly disrupt incumbent giants like Facebook and Twitter - so we’ll be keeping a keen eye on the metrics in this dashboard.

CitaDAO - Tokenized Real Estate

Tokenized real estate has long been an aspiration, but so far efforts have met with mixed results.

CitaDAO, a DeFi real estate platform, claims that the ecosystem has now developed to the point where it’s viable.

CitaDAO is a Decentralized Finance (DeFi) platform for Real Estate to be tokenized on-chain, built on the Ethereum ecosystem. CitaDAO aims to solve the lack of liquidity, access limitation, and lack of composability in the existing real estate ecosystem by creating interoperability with other DeFi applications and primitives that operate on the Ethereum protocol.

Let’s have a quick look at how it’s doing so far.

IRO stands for Introducing Real Estate On-chain, an attempt to fund the purchase of a RE asset. The community commit stablecoins to the IRO in an attempt to reach the “soft cap” - the minimum commitment needed for a successful IRO.

The first attempt at an IRO was to buy a property in Cardiff, Wales in early March - covered in this dashboard.

Daily commitments reached $2 Million in the first day from dozens of investors. After a couple more six figure days, things slowed down for over a week until a Whale came in with a $4.8 Million commitment:

There were 233 unique participants that committed $8,046,670 in total to the genesis IRO.

Unfortunately the IRO failed, only securing around 69% of the $11.68 Million required to meet the soft cap.

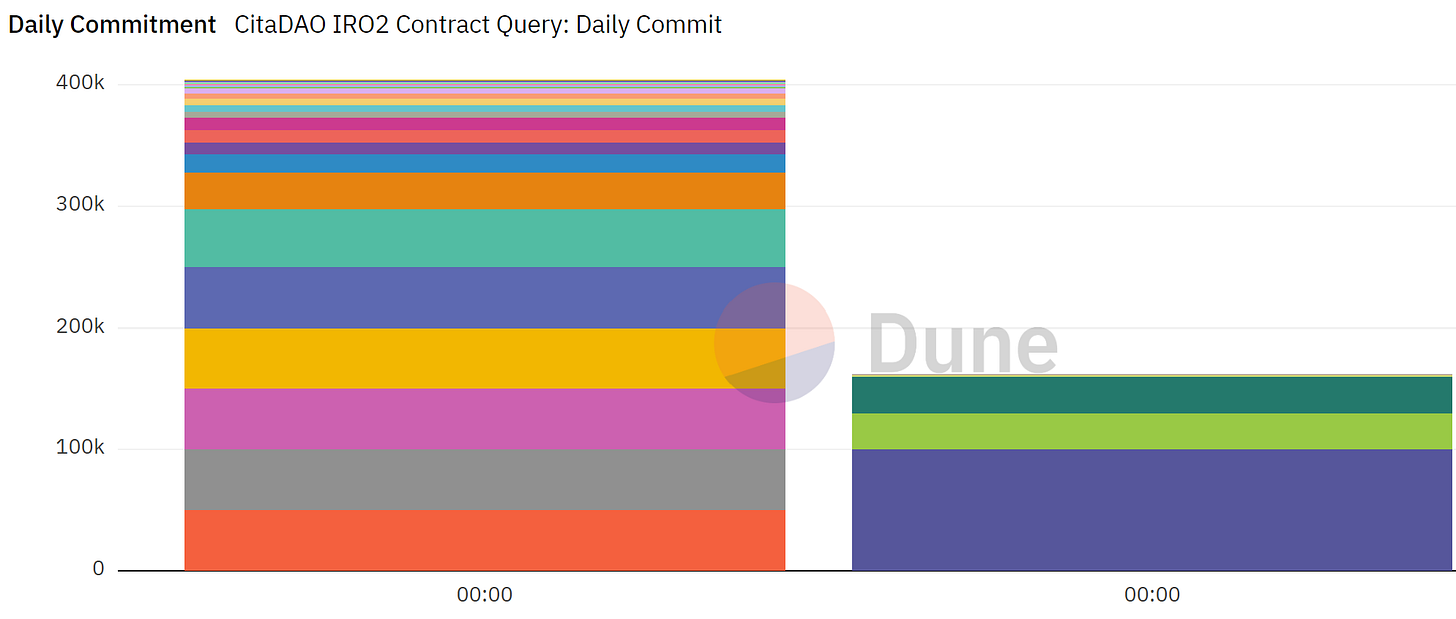

Undeterred, yesterday they launched a new IRO, this time for an 8 story industrial space in Singapore, covered in this dashboard by @ethnoweth.

Yesterday over $400,000 was committed by an array of investors:

And in total $567,065 has been committed in total.

The soft cap is much smaller this time at $630,000. Considering that they’re around 90% of the way there, with 5 days left to contribute - there’s a good chance that CitaDAO will have a successful IRO on their hands.

This could be interesting to follow and see how it’s managed.

Will this be the first attempt at tokenized real estate that properly works? Check out the full dashboard and decide for yourself.

Is X2Y2 Catching up with LooksRare?

Despite competitors emerging over the past year, it still looks like the NFT marketplace crown is sitting securely on OpenSea’s head.

There’s lively competition on the level below though. Let’s see what’s happening through a new dashboard by @cryptuschrist: X2Y2 vs LooksRare - Race for 2nd Place.

As far as all time volume, LooksRare is massively ahead at over 9.1 Million $ETH compared to “just” 307.7k $ETH on X2Y2.

After a spectacular first month though, LooksRare cooled off volume-wise from February through to early May before dipping further over the past couple of weeks:

During the same time period X2Y2’s volume surged to new heights from early April:

This has lead to X2Y2 gaining serious ground in terms of volume, with LooksRare’s share of combined volume dropping from 99%+ in March to as low as 29.5% in the past week:

When it comes to actual sales, X2Y2 is outpacing LooksRare.

For example, over the past week X2Y2 had 29,089 sales and LooksRare had 16,209.

X2Y2 also wins out in all time sales:

As for users, LooksRare was still ahead in terms of unique buyers and sellers over the past week. But user growth since March has been less noticeable compared to their rival which has seen significant gains.

Overall, when we look at the most important metrics like users, daily volume and sales - we can see that there is something of a race for second place!

Will one win decisively? Which will it be? Take a look at this impressive dashboard to decide.

Euro Stablecoins are Growing

We’re all used to stablecoins pegged to the USD, but there’s a whole ecosystem of stables out there for the Euro, Pound, Yen and more.

A recent dashboard by @johnz focuses on 7 Euro stablecoins on Ethereum. Let’s take a look……

The total market size is now 447,146,779!

While the EU has lagged the US in crypto innovation, both demand and liquidity for Euro stablecoins grew significantly in late 2021 and early 2022:

Launched by Bitstamp in Summer 2021, $EURt has the deepest liquidity after major supply growth at the beginning of 2022:

There are currently 233.6 Million $EURt on Ethereum.

The leader in terms of trade volume though is $agEUR, an overcollateralized stablecoin created by Angle Protocol:

The development of the EU crypto market is an interesting one to watch, and these stables will be a crucial part of it. Check out the full dashboard for more!

Batch Send NFTs on GEM

NFT aggregator GEM, which we’ve covered extensively before, has shipped a nice new feature.

Users can now “batch send” multiple NFTs between wallets at once, saving on time and gas.

@bakabhai99s released a dashboard showing that over 500 NFTs have been sent in just 87 transactions……

Yesterday, users sent 279 NFTs in just 31 transactions!

Since Gem was recently acquired by OpenSea with a view to improving the UX for power users, it’ll be interesting to see what else they come up with in the coming months.

Check out the full dashboard for more details.

More Dashboards

GN

Thanks for reading, and as always a special thanks to all the Wizards for their amazing work.

We’ll see you again next week for more data, dashboards and Wizardry. Have a good weekend - the data must flow 🧙