GM

Welcome to another edition of Dune Digest.

We have plenty of data for you this week.

Firstly though - some very exciting Dune news…..

LLMs & the future of Dune

It has become increasingly obvious recently that LLMs are a gamechanging technology poised to revolutionise the careers of millions.

Dune Wizards are no exception.

This week Dune’s CTO and co-founder Mats shared an exciting roadmap for the LLM features we’re going to ship in the near future.

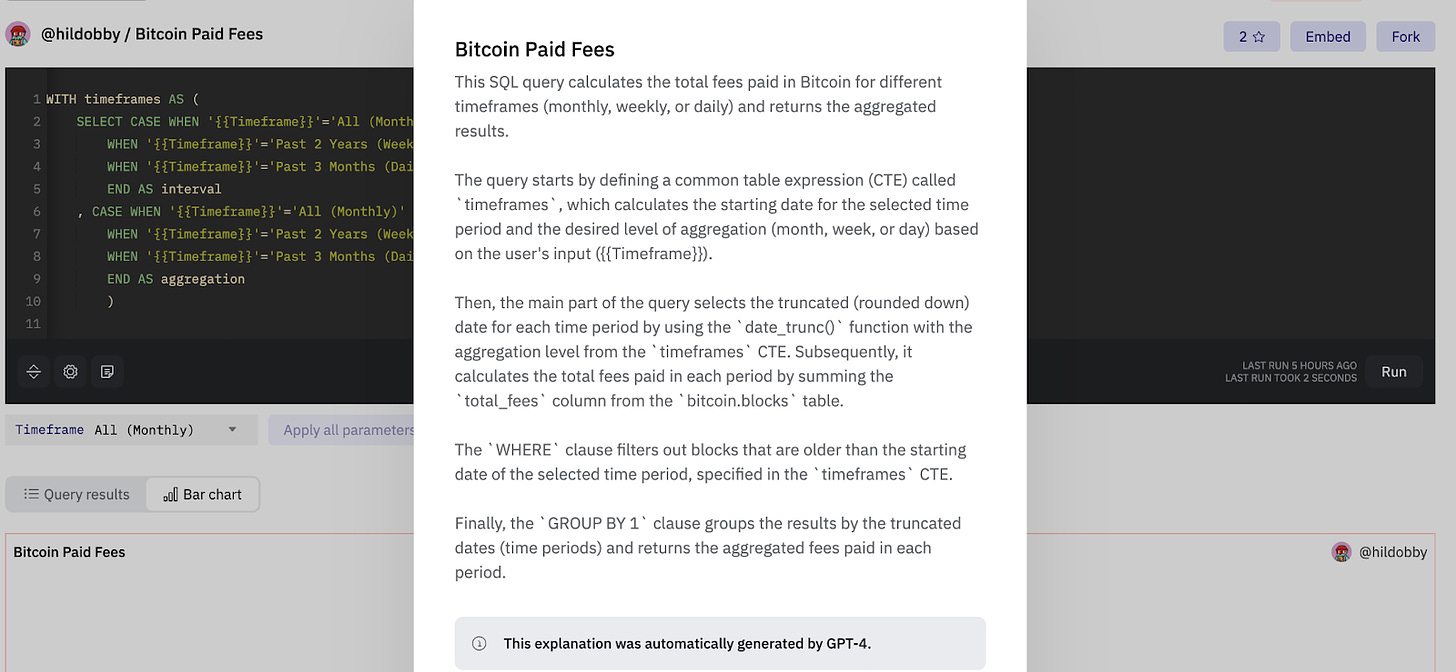

The first one, query explanations, went live this week!

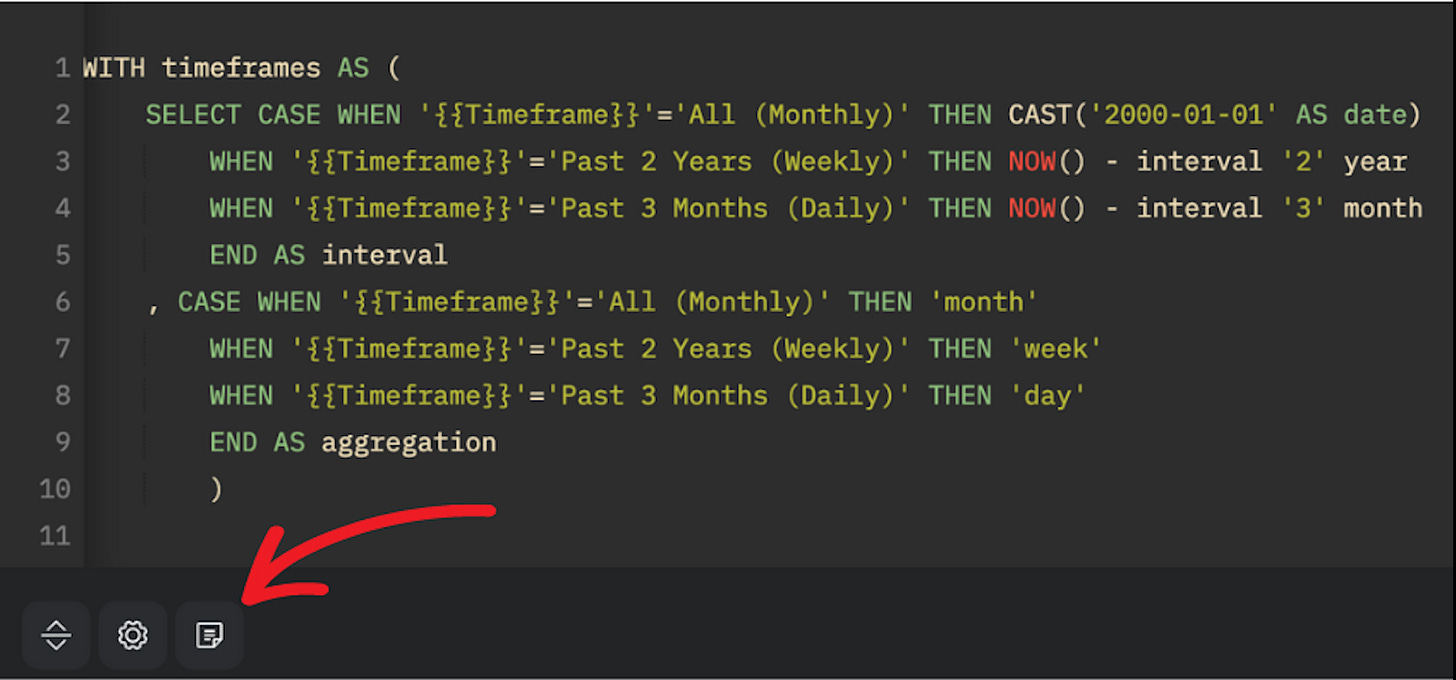

Have you ever looked at a complex query and thought……. “what?!”

No longer. Now you can just click on a small but powerful new button:

And GPT4 will spin up a comprehensive explanation of the entire thing!

This is going to make learning SQL and data analysis much easier!

And this is only the start.

We have a host of other features planned like:

Query translations

Natural language querying

AI enhanced search

Wizard knowledge base

And many more!

Take a read of the full article to learn what’s ahead.

Now, let’s get into the data……

Ordinals Marketplaces

Ordinals, the “NFTs on Bitcoin” craze of the past few months, are still going strong.

Over the past couple of months we’ve seen the emergence of a whole community around them, and even dedicated marketplaces.

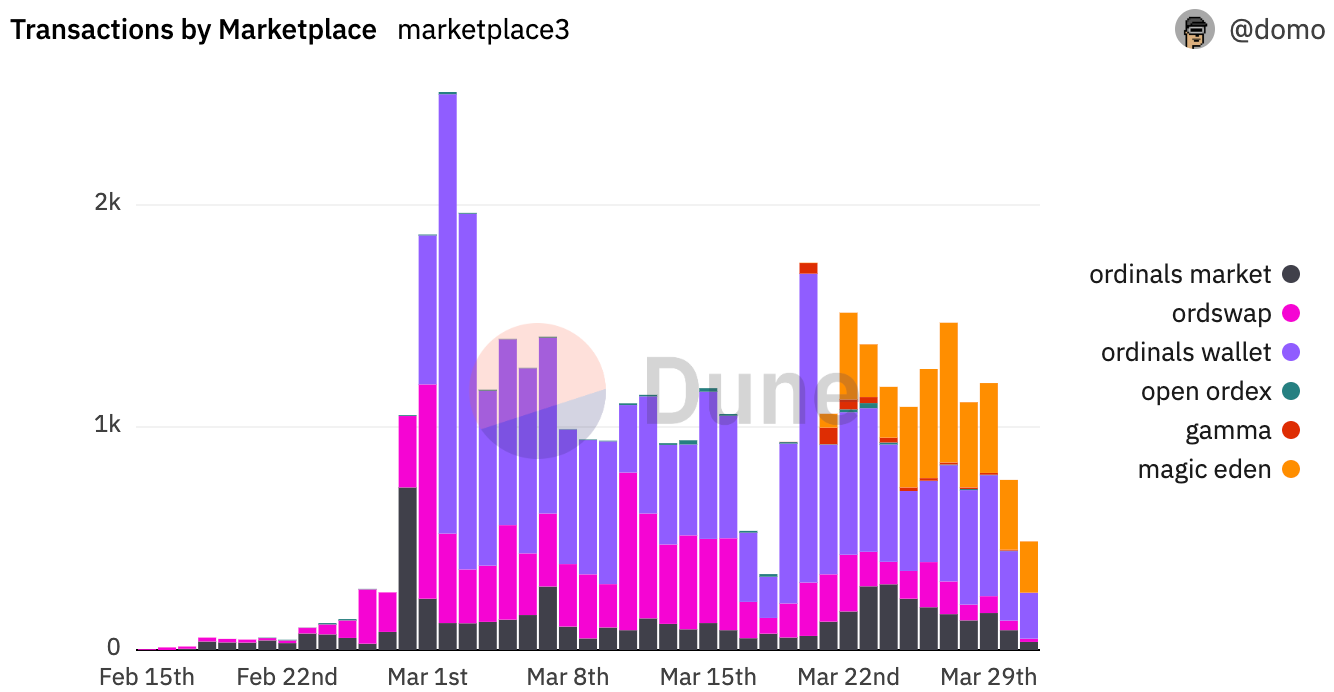

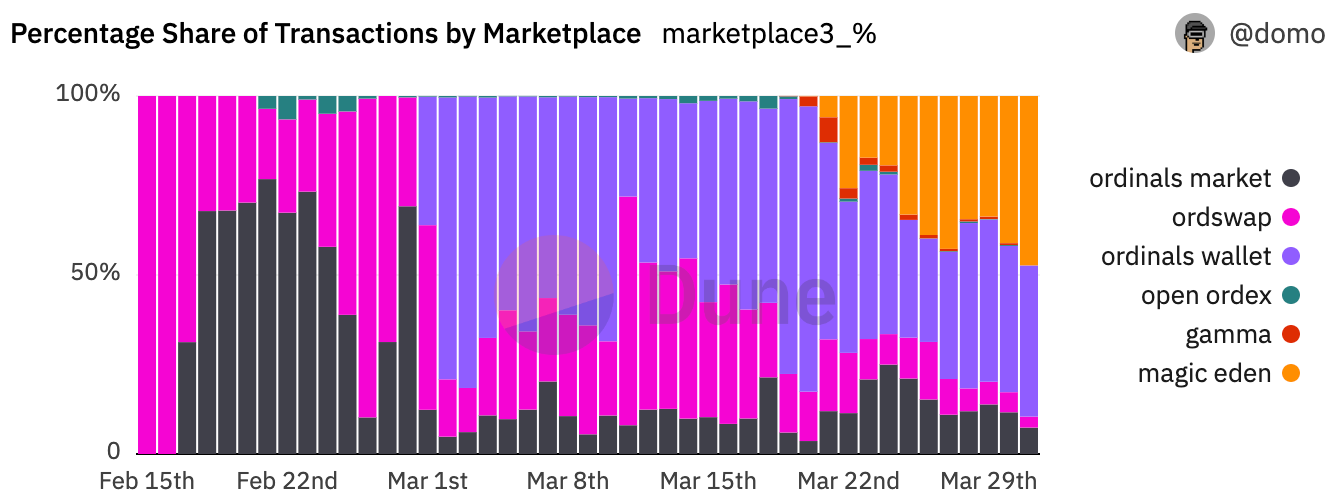

A fascinating dashboard by @domo explores Ordinals marketplaces - let’s take a look…..

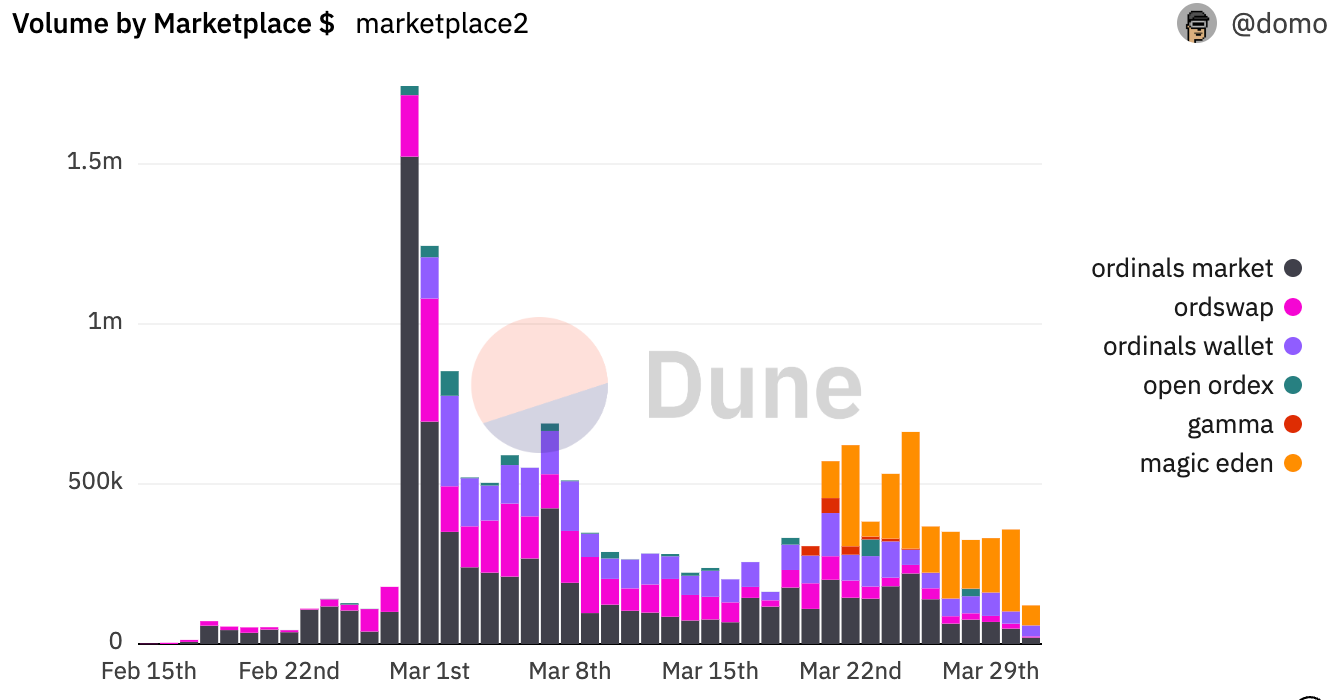

Multiple ordinals marketplaces have sprung up over the past couple of months including:

ordinals.market

Ordswap

Ordinals Wallet

Open Ordex

Gamma

These marketplaces were smart to jump on such a booming trend, and have collectively seen:

~$16m in volume

39.1k trades

18.46k users

Last week Solana’s biggest NFT marketplace Magic Eden also announced the launch of its own Ordinals marketplace.

March was the month these platforms burst onto the scene. Transactions peaked on the 2nd, but have been steady since at ~1k - 1.5k daily.

Ordswap and Ordinals market were the only game in town until March, when Ordinals Wallet launched and quickly scooped up marketshare.

Over the past week, Magic Eden has made serious gains, moving toward the top spot. Open Ordex and Gamma remain small players:

Volume peaked on the 28th of February, exceeding $1.7M in a single day - mostly on Ordinals Market.

Volume fell through mid-March, but has started to grow again over the past week, hitting $500k+ on several days:

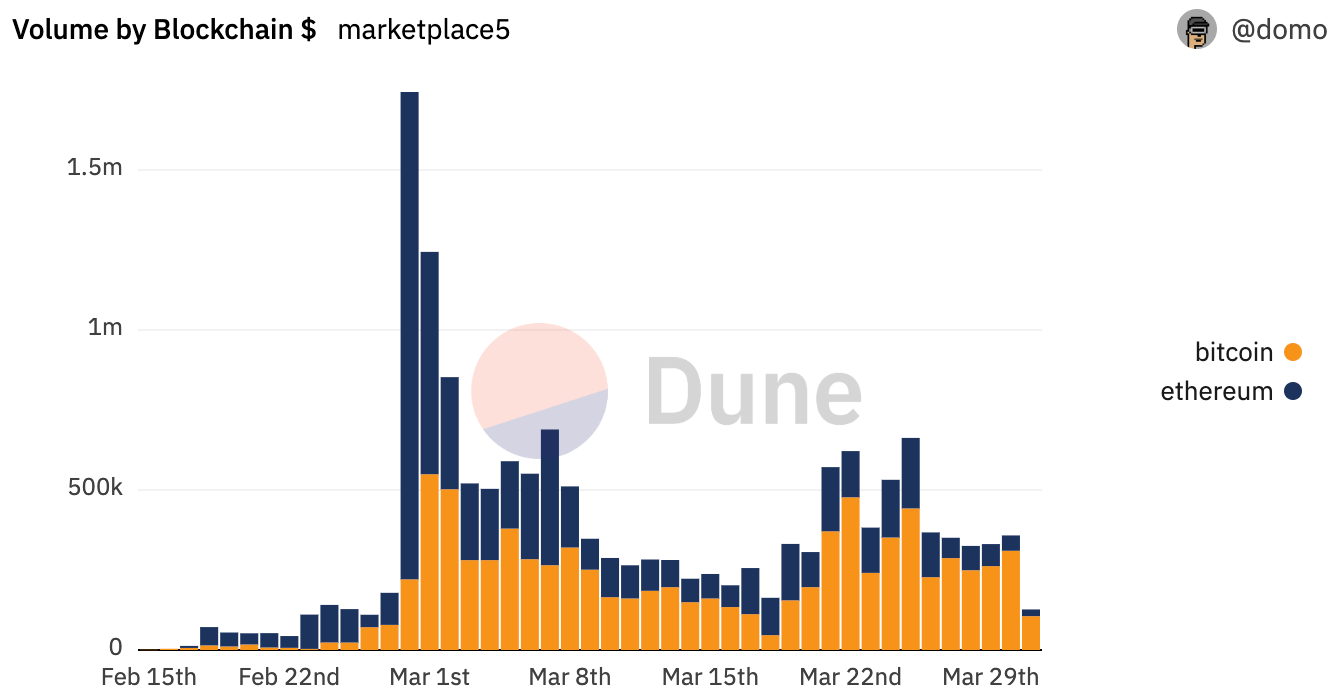

We can also see that the majority of volume has been directly on Bitcoin itself, with a sizeable minority on Ethereum:

It’s interesting to see how fast entrepreneurs and businesses in this space react to new trends and opportunities!

Whatever happens to the Ordinals market, these platforms are well poised to become big players - check out the full dashboard for more……

ZkSync Era

2022 was the year of Optimistic rollups, will 2023 be the year of their zero knowledge cousins?

This week Matter Labs won the race to launch the first EVM-compatible rollup secured by zero-knowledge proofs - ZkSync Era.

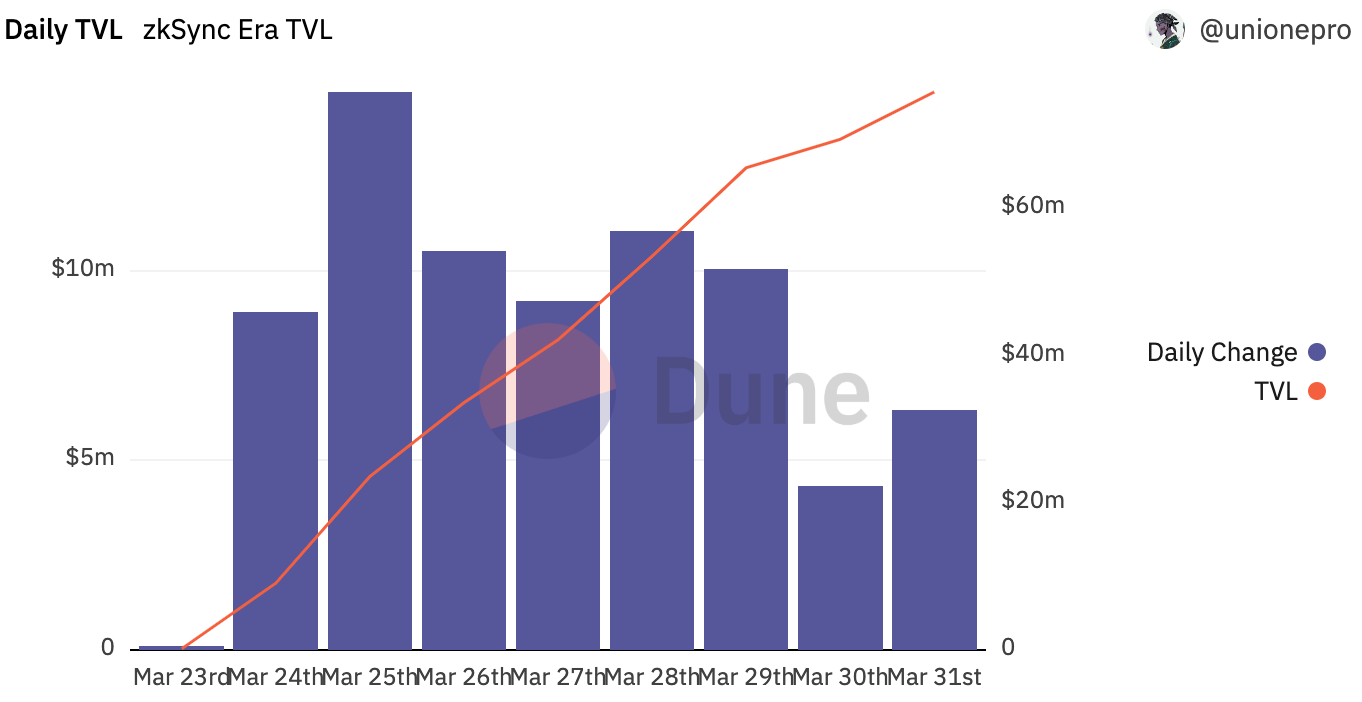

Users have been bridging to the new network like crazy, tracked by a new dashboard by @unionepro.

The bridging began in earnest one week ago, remaining steady through the past week:

Since then - 187,934 addresses have deposited assets worth almost $76 million:

Over 90% of addresses deposited <$1000, but as always there have been some bigger players getting in on the action:

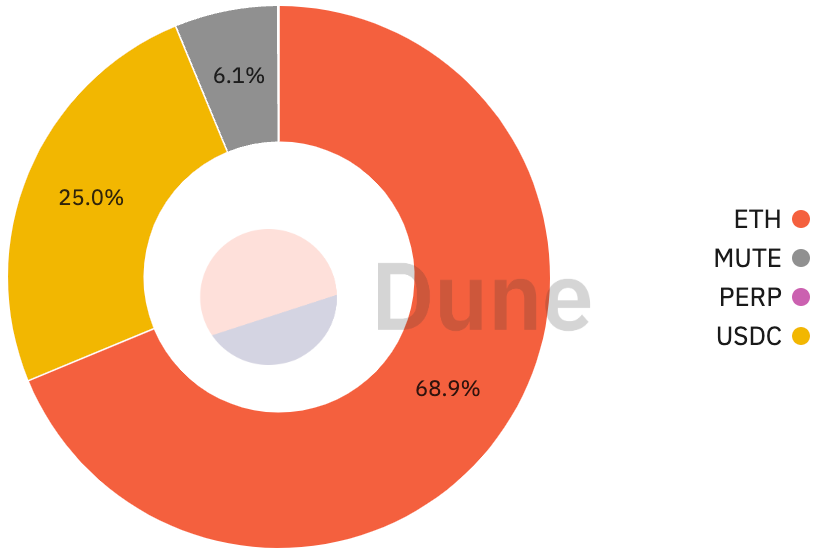

The majority of value was deposited in $ETH ($52.5m), and $USDC ($19m) - with a minority sending tokens like MUTE and $PERP:

It seems like users are keen to test out this cutting edge tech! The speculation of a possible future airdrop is also no doubt driving some portion of the interest.

Era will be an ecosystem to keep an eye on in the coming months - check out the full dashboard for more……

y00ts

Around one year ago, Solana was looking like the hot new destination for NFT trading. Sadly, in recent months, the network hasn’t been doing well as one of the major casualties of the bear market.

One of the major NFT powerhouses on Solana is DeLabs - creators of Solana bluechip collections y00ts and DeGods.

This week it was revealed that both of these collections are jumping ship, in y00ts’ case to Polygon, the deal having been sweetened by a cool $3 million.

A new dashboard by @polygon_analytics tracks the recent action, let’s take a look……

y00ts is a 15k collection, and so far around ~78.6% of them have been bridged over to their new home:

Out of these, 9.7k are staked!

The secondary market is also off to a good start, with only 355 sales driving more than $1.45 million in volume:

DeGods are also on the move - this time to Ethereum.

Most of them at least - 535 were burned and reinscribed as Ordinals on a single Bitcoin block…..

Overall this is pretty interesting stuff, suggesting that NFT collections can transcend their chain. Even if the network is floundering, a bluechip is a bluechip and can be ported over to greener pastures.

The addition of Ordinals to the market makes the competition between chains even fiercer!

To learn more about the DeGods migration - check out this dashboard by @subinium (who has been on fire lately).

And to learn about y00ts, take a look at this one!

Where do DeFi users Trade NFTs?

@sealaunch are some of the best NFT focused Dune Wizards in the game. This week they released another fascinating analysis, exploring the overlap between DEX traders and NFT marketplace users.

Let’s see what they found…..

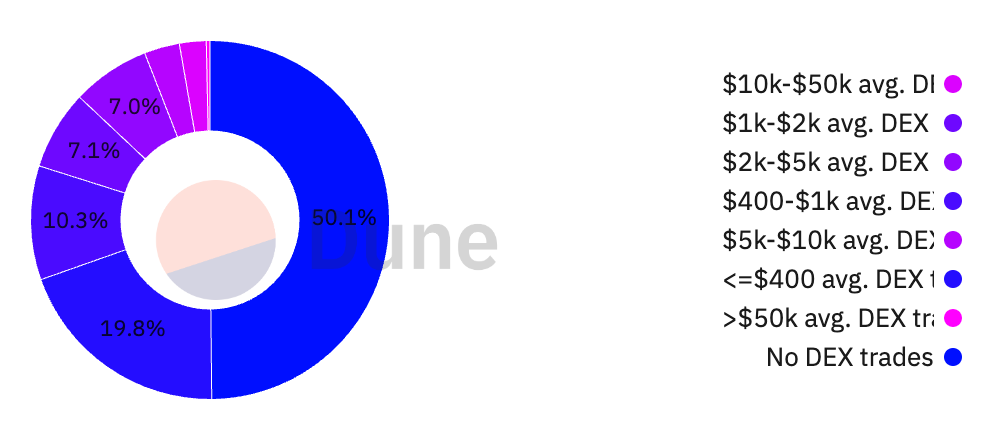

The analysis focuses on OpenSea and Blur. Over the past 3 months, ~50% of OpenSea users had never traded on a DEX. Of those who had, the majority were smaller traders:

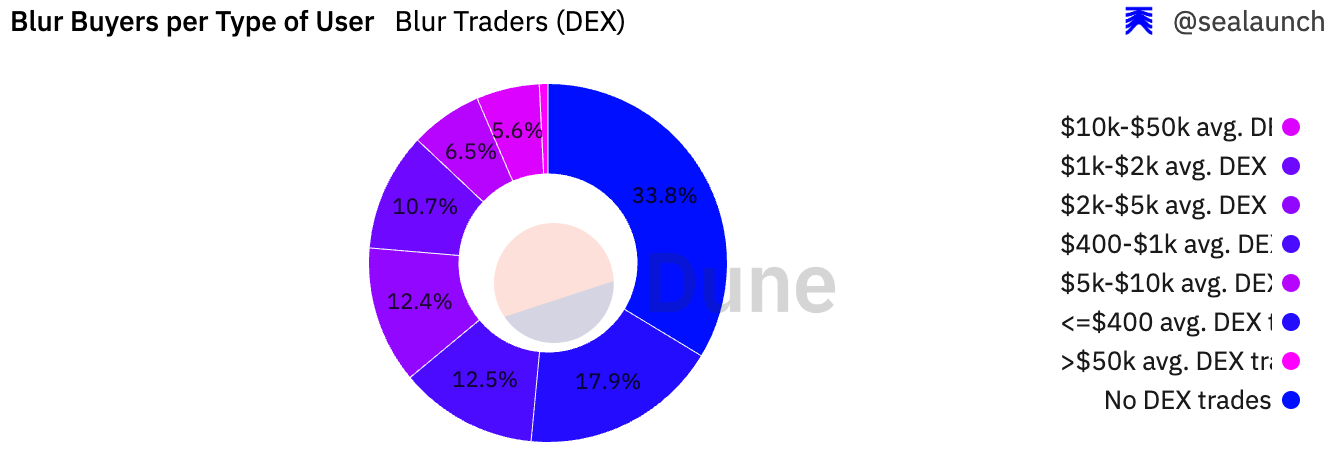

On the other hand, only 33% of Blur buyers had never made a DEX trade - and a larger percentage are higher value traders compared to OpenSea:

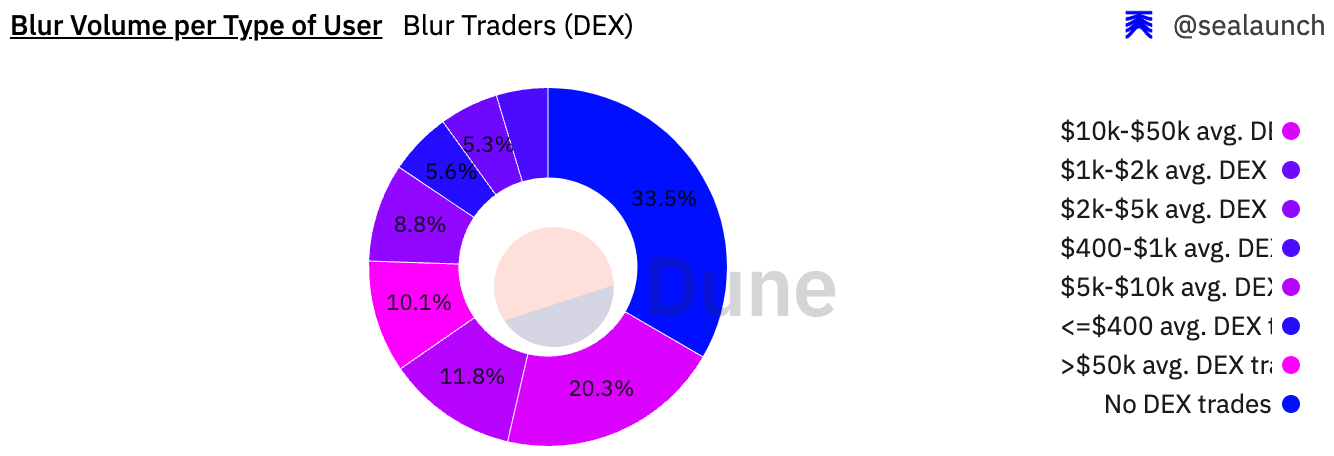

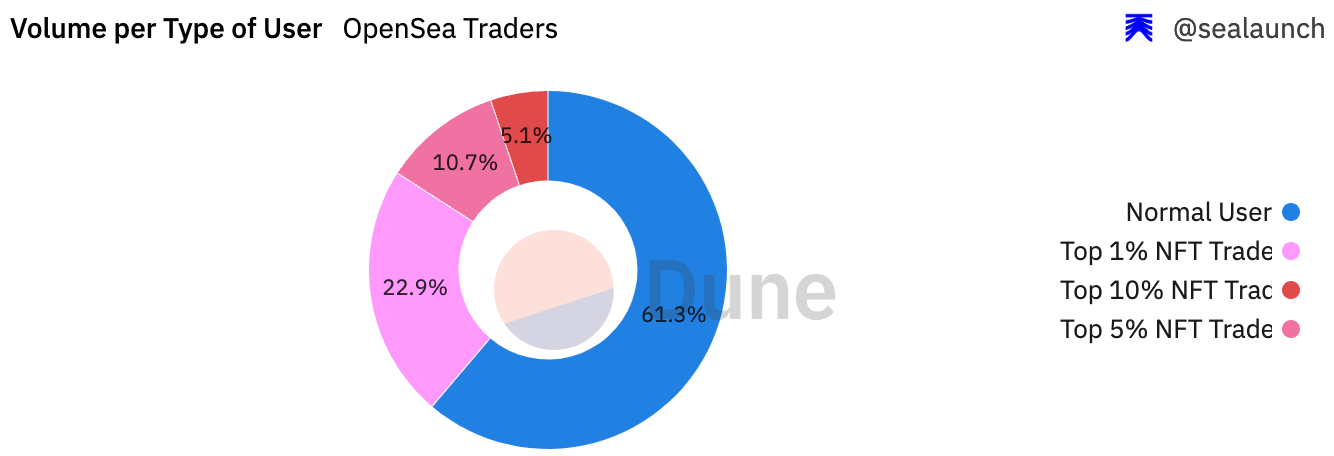

When it comes to the volume per type of user, the difference is more stark.

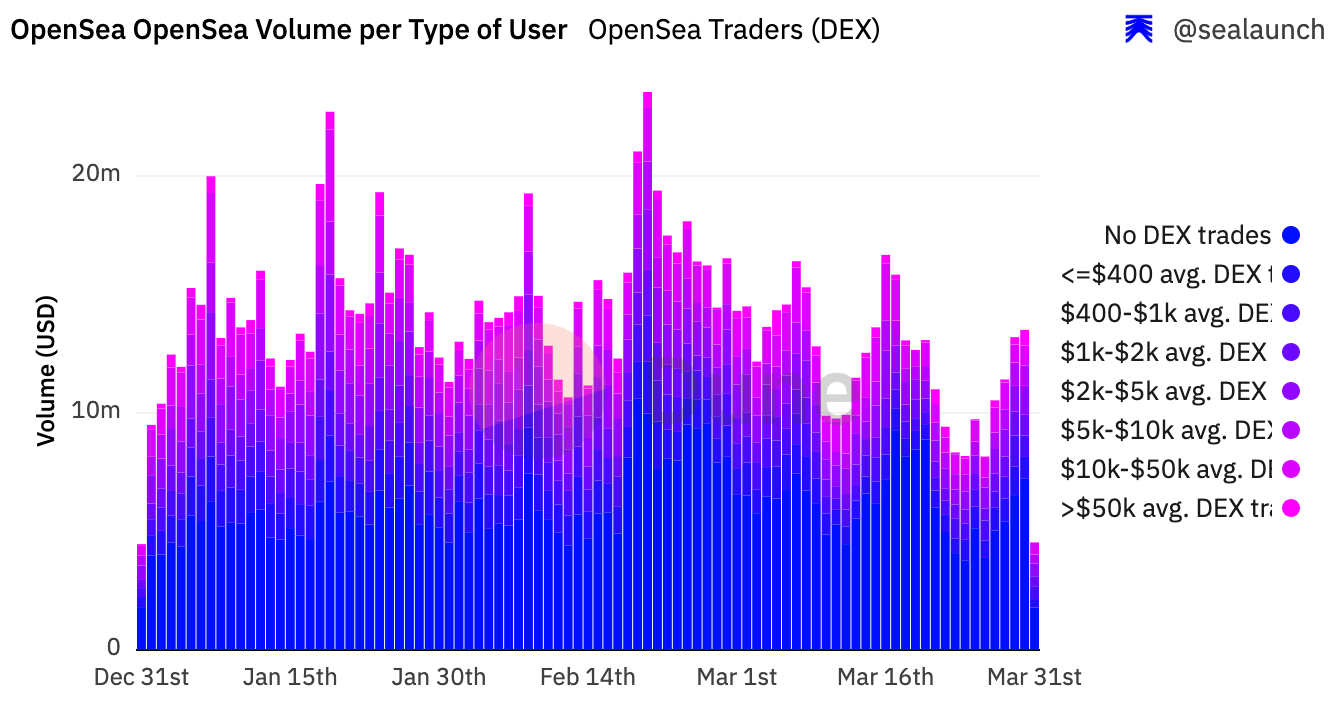

On OpenSea, a significant majority of volume is driven by wallets which have either never traded on a DEX, or have only traded small amounts:

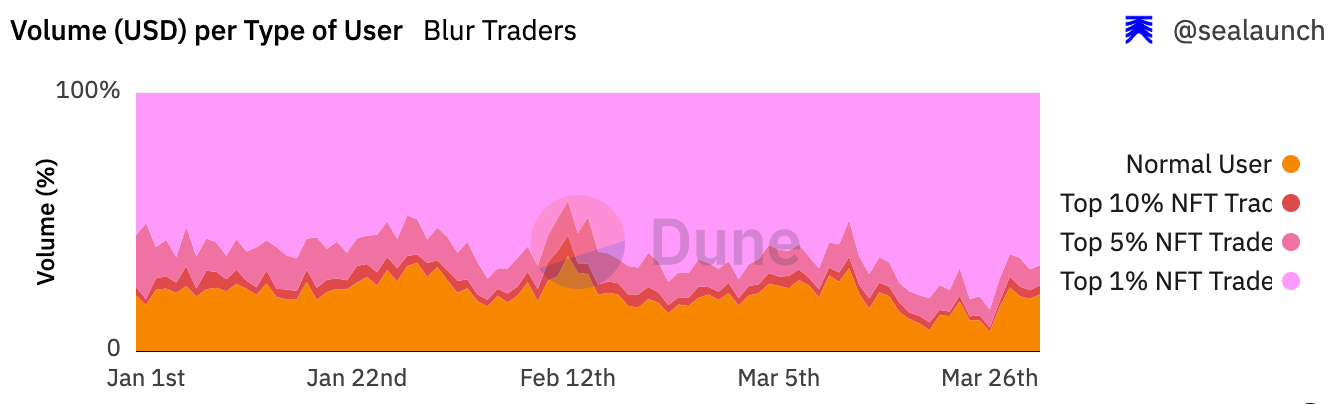

In contrast, far more of Blur’s volume is driven by high-volume DEX traders.

As @sealaunch point out in their thread on the topic:

“On OpenSea, less than 3% of volume comes form users that trade +$50K on DEXs. 52% of volume comes from users that trade less than $400 on DEXs. On Blur, 41% of volume comes from users that trade on average +$10K on DEXs. 10% of volume comes from users that trade +$50K on DEXs”

@sealaunch also came out with another interesting related dashboard, looking at the activity of top NFT traders across both platforms.

They found that ~60% of OpenSea volume comes from “normal” users, and ~25% from the top 1% NFT trading elite.

On the other hand, a significant majority of 70-80% of Blur’s volume is driven by top 1% traders.

A similar pattern plays out across trades themselves. On OpenSea, ~80% of trades are by “normal” users, on Blur they only account for ~50%.

All this is to say that Blur seems to have succeeded in its drive to become a “power user” platform for professional traders, for now at least.

Check out the full dashboards for more:

Top 1% - Dashboard / Twitter thread

DEX users - Dashboard / Twitter thread

Stablecoins

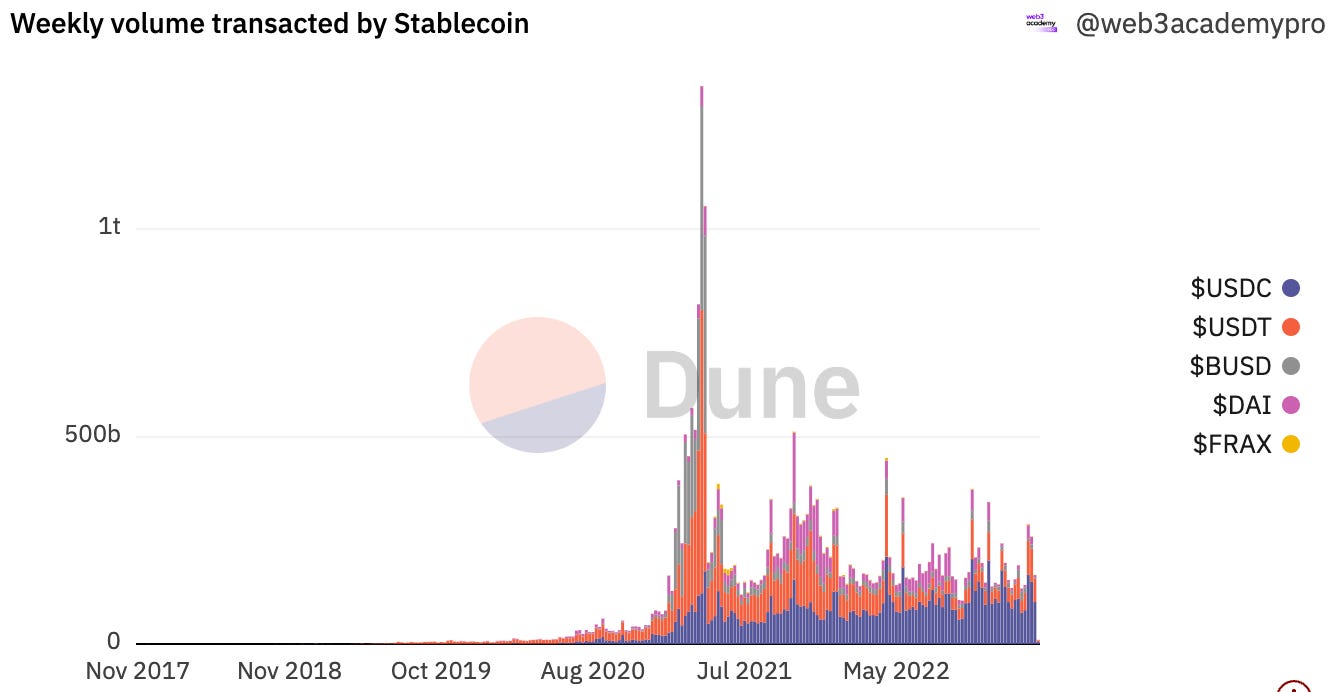

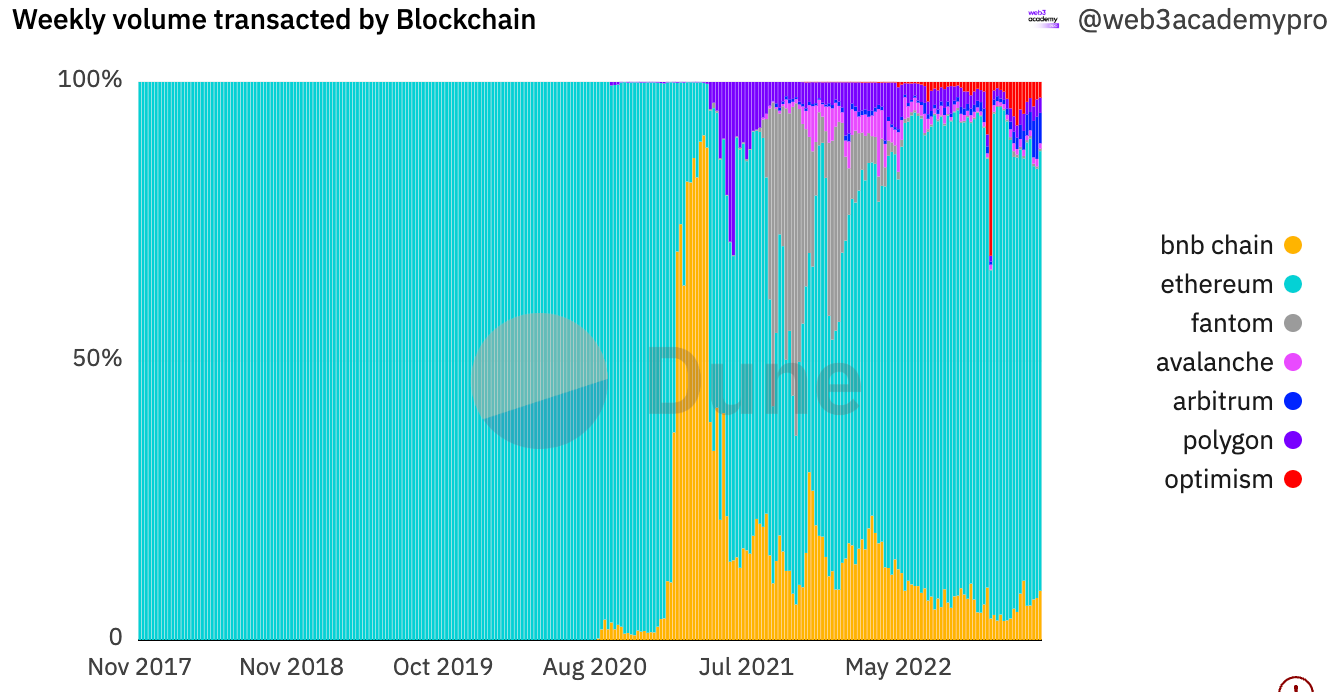

We haven’t focused on stablecoins for a while here at Dune Digest. A new dashboard came out this week though by @web3academypro that has some neat insights.

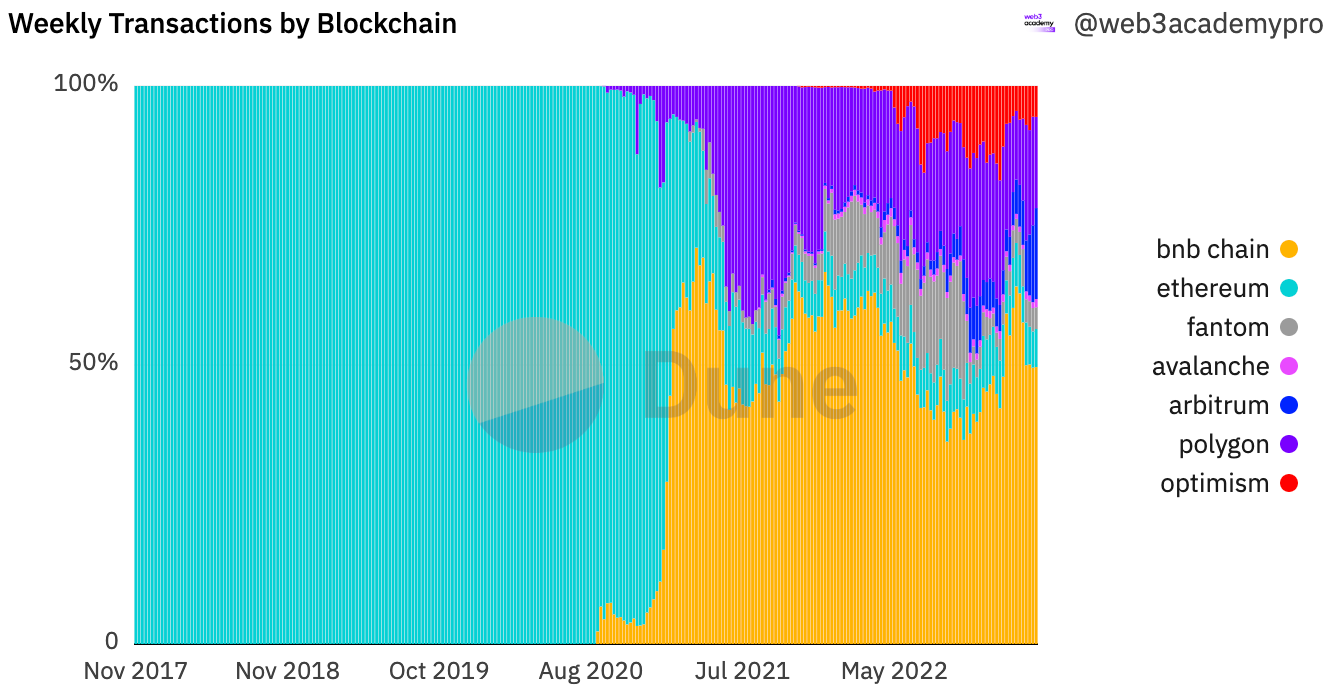

It’s interesting to see how stablecoins really came into their own from early 2021, growing from 2 to 20 million weekly transactions in one year.

Over the past few months, transactions across major chais have hit new heights:

The boom in overall transactions coincided with the launch of stablecoins on L1s other than Ethereum - which went from 100% of transactions to ~15% in one year:

Even though transactions have been all over the place, volume has been relatively steady through the same period:

And unlike with transactions, Ethereum still dominates on the volume front:

There’s much more in this dashboard - a great stablecoin resource.

More Dashboards

GN

Thanks for reading, and a special thanks to all the wonderful Wizards for contributing this week.

See you again next week for more data, dashboards and Wizardry.

thanks for news , appreciate

new highest and top 10 marketplace are below

1 . ordinals marketplace BTC and BRC

2. opensea for ERC20